Maximize Customer Retention in 2024: The Salesforce Approach for Financial Institutions

Jenna Trott | NOVEMBER 26, 2023 | 5 Minute Read

For many, the ending of another year brings about a period of reflection on the successes and challenges faced. But it also serves as a time to critically look toward the future, and how we can all innovate faster and smarter without compromising on the integrity of our businesses. For the financial services industry, the last year has brought about an explosion of evolution, driven by technological advancements and changing customer expectations. As customers demand personalized, comprehensive experiences and seamless digital interactions, financial institutions found themselves faced with the challenge of meeting these needs. In this article, we will explore why customers are motivated to switch financial services institutions, what they look for in a great digital experience, and how Salesforce can help enhance customer experience in the future of financial services.

Why Customers Switch Financial Services Institutions

In the ever-evolving world of financial services, it’s crucial to understand why customers decide to part ways with their institutions. Every preference, every choice, and every switch tells a story. Without capturing the reasons behind customer behavior, institutions are left in the dark about why clients are leaving. Is it a slow response to their needs, a desire for more personalized services, or the appeal of smoother digital experiences elsewhere? Without digging into these details, institutions might end up treating symptoms instead of the real issues, leading to a never-ending cycle of customer departures. Let’s take a look at some of the reasons why your clients may be unhappy (and motivated to leave).

Experiences Aren’t Personalized

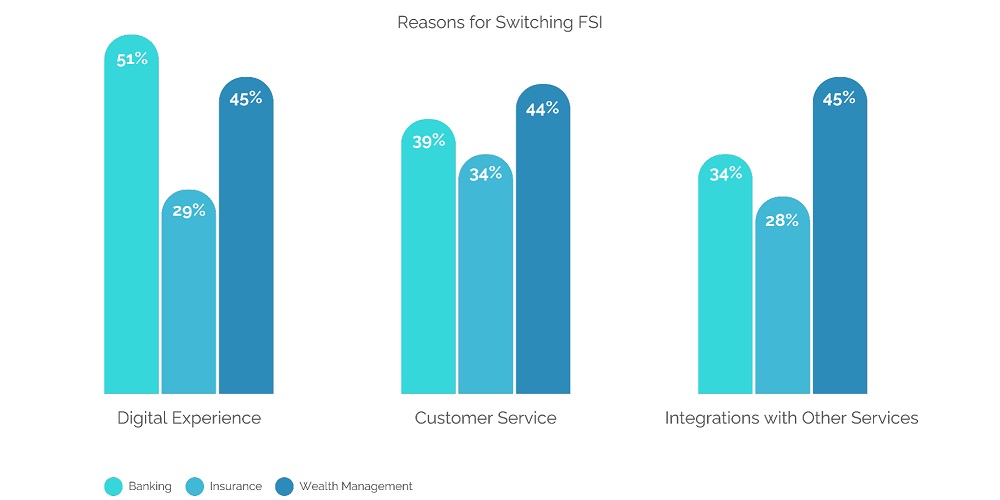

According to a 2023 Salesforce survey, significant percentages of customers across banking (35%), insurance (34%), and wealth management (25%) switched providers in the past year. The primary reason for this trend across all three sectors? The desire for superior digital experiences. Customers want to feel like more than just a number to their financial institutions, they want to know that their unique needs are not only understood but are made a priority. If not? Over half of those surveyed would switch financial service providers. This illuminates a crucial necessity for financial service institutions to dive into the world of hyper-personalization, crafting tailored solutions that resonate deeply with each customer’s unique needs and preferences.

In these tumultuous economic times, customers are Increasingly turning to their financial service institutions for essential support, advice, and direction. However, a staggering 79% of customers feel that their financial service providers have failed to adequately assist them in navigating the uncertainties of today’s economic landscape. The upheavals and disruptions in daily life amidst economic uncertainty can pose significant challenges – people want to be reassured. Thus, clients turn to their financial institutions for guidance and support, yet the outcomes have been mixed. While one in five customers acknowledge substantial help from their financial institution in preparing for the current economy, dishearteningly, over a third express receiving no assistance at all. These statistics paint a concerning picture, revealing a considerable gap in the support provided by financial institutions during these trying times.

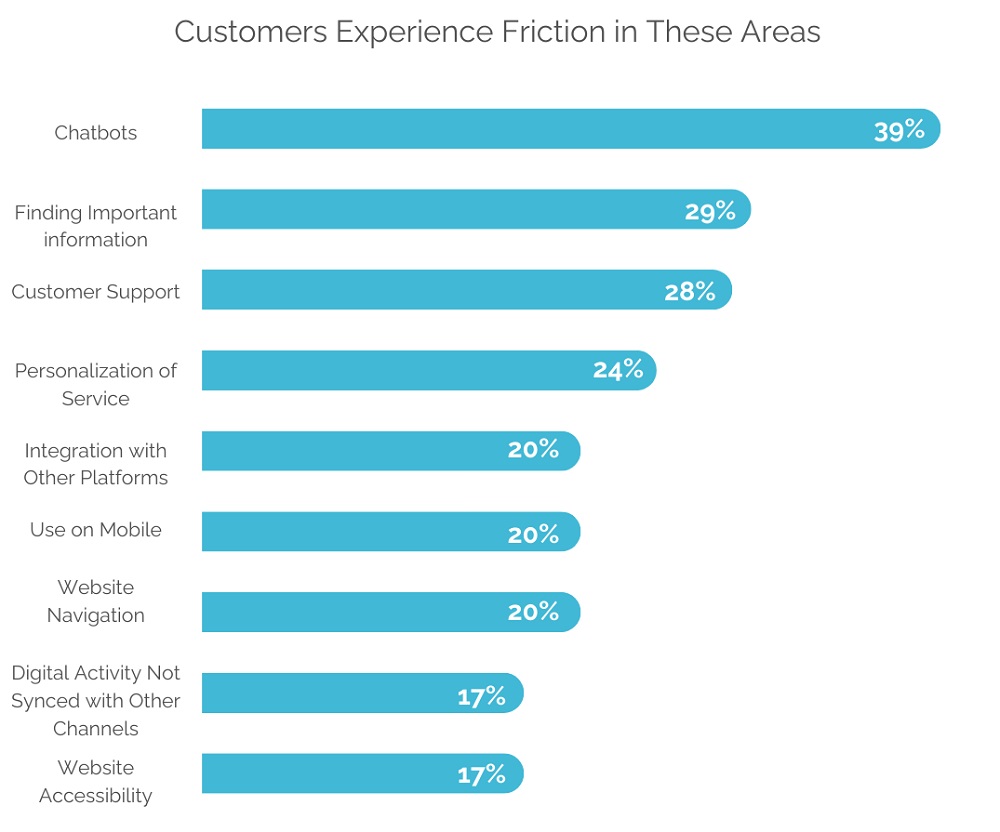

These days, a seamless digital experience stands as a paramount demand. However, despite the widespread integration of chatbots across industries, there remains a notable issue: poorly integrated and non-intelligent chatbots have become a prime source of digital frustration, echoing loud in feedback with 39% of customers left disgruntled. This particular shortfall in chatbot functionality signals a larger trend, indicating that certain implementations are failing to keep pace with the evolving needs of consumers. Customers express frustration over several other facets, such as the struggle to swiftly access crucial information, subpar customer service, impersonal interactions, inadequate integration with other platforms, lack of mobile compatibility, and more. These pain points collectively spotlight an imperative for the financial services sector: the necessity of investing in and enhancing their digital offerings to align with the ever-Increasing expectations of today’s tech-savvy clientele.

What Customers Want

In the wake of departures spurred by lackluster digital experiences and unmet expectations, the question arises: what draws customers toward financial institutions? Let’s take a look at what financial institution customers are looking for in 2024 and beyond:

Better Digital Experiences

The fact of the matter is that customers anticipate and demand the capability to oversee a significant portion of their financial affairs through online channels, particularly when it involves routine tasks. Salesforce’s research shows that 72% of banking customers, 71% of insurance customers, and 69% of wealth management customers want to be able to apply for various financial products online. This demonstrates the importance of providing a clear and user-friendly digital process for customers.

However, it’s not just about seamless digital experiences; customers anticipate a connected, multichannel experience from the human side of their financial institution too. Be it banking, wealth management, or insurance, customers largely favor communication via phone. This Inclination underscores a fundamental need to feel recognized, understood, and cared for. This means that when a customer reaches out for assistance, the last thing they want is to be tossed between departments, reiterating their concerns endlessly. What they seek are empathetic, prompt solutions that address their needs without unnecessary delays or transfers. This underscores the essence of personalized, responsive service that forges lasting connections and builds unwavering trust between customers and their financial institutions.

In today’s landscape, customers from various industries are unequivocally seeking services tailored to their individual life situations. The statistics underscore this sentiment with a remarkable 73% of customers now expecting companies to anticipate their distInct needs and aspirations. The consequences of overlooking this personalized service aspect are weighty; over half of the customer base asserts they would readily switch providers if the services offered lack personalization. This preference highlights a clear directive for banking and insurance providers: the marrying of digital innovations with a human touch could result in a substantial competitive advantage.

How Salesforce Can Help

Salesforce, the world’s #1 CRM, stands out as the superior choice for financial service companies for many reasons. In addition to being a robust and adaptable platform offering tailored solutions specifically designed for the complexities of the financial sector, it also addresses the many concerns and pain points expressed by financial institution clients today. Here’s how Salesforce can help prepare your financial institution for 2024 and beyond:

Leveraging Data for Personalization

Salesforce’s CRM platform serves as an indispensable tool for financial service institutions, enabling them to harness customer data effectively to craft deeply personalized experiences. Through the meticulous capture and analysis of customer information, financial service institutions unlock valuable insights into preferences, behaviors, and evolving needs. This data-driven approach becomes the cornerstone for financial service institutions to meticulously tailor their offerings, offer highly tailored recommendations, and proactively anticipate customer requirements. This has proven to pay off with 65% of customers willing to stay loyal if the company offers a more personalized experience.

Seamless Integration Across Channels

Meeting the demands of today’s digitally connected customers can be a challenge. With Salesforce’s dynamic CRM platform, financial service institutions achieve more than seamless integration across channels – they unlock a symphony of customer connections. The platform’s emphasis on quick, accessible information retrieval and consistent experiences across diverse customer touchpoints addresses the evolving demands of digitally connected consumers. From the Experience Cloud to Service Cloud and Customer 360 Data Manager, Salesforce offers a suite of recommended products empowering financial service institutions to deliver unparalleled digital service. So whether your clients prefer face-to-face meetings, phone calls, emails, online chats, or text messages, Salesforce harmonizes interactions across every touchpoint.

Salesforce’s CRM platform empowers financial service institutions to not only respond but proactively engage with customers, particularly during challenging times, showcasing empathy and genuine care. Through automated yet personalized communications and the provision of tailor-made solutions, financial service institutions can forge a deeper sense of trust, cultivate unwavering loyalty, and fortify their customer relationships. This proactive outreach allows financial service institutions to anticipate customer needs, address concerns before they escalate, and stand as dependable partners in navigating uncertainties.

Superior AI Capabilities

In today’s rapidly evolving financial landscape, artificial intelligence (AI) is proving to be a game-changer for financial advisors seeking to retain their client base. Einstein GPT from Salesforce holds significant potential as a game-changer, especially in the realm of personalized communications and recommendations. Integrating both public and private AI models with CRM data, Einstein GPT allows users to present natural-language inquiries directly within the Salesforce CRM. This results in an ongoing flow of AI-generated content, dynamically customized to adapt to changing customer details and preferences. With Einstein GPT at their fingertips, financial advisors can nurture deeper and more personalized client relationships, leveraging AI to facilitate conversations that align precisely with individual needs and aspirations. Check out even more ways that Salesforce’s Einstein AI may benefit your financial institution here.

Why AGG?

When it comes to selecting the right partner for technology integration and digital transformation, the experience of the company you choose is of utmost importance. Access Global Group is a Salesforce Summit (Platinum) level partner with nearly two decades of experience in Salesforce support, maintenance, and management services. Our team of certified experts knows Salesforce inside and out, meaning that when they come to you, no stone is left unturned and any conflicts are quickly addressed with agility and accuracy. With 5-star ratings on the Salesforce Appexchange and G2, our team offers a unique blend of global deployment expertise coupled with the agility of a boutique firm and a one-of-a-kind project methodology that places our clients at the forefront of every decision. Your successes are our successes, so we’re dedicated to providing solutions that align with your evolving requirements and aspirations.

We invite you to reach out to us with any questions or concerns regarding your Salesforce instance, we’d be happy to discuss a solution that best fits your needs at this time.

Get the latest Salesforce news

Subscribe to get the latest Salesforce blogs, guides, industry reports, events, and all things Salesforce related!

From proposals to quotes, contracts and more, Access Docs allows users to create and send consistent and accurate documentation to clients in a few simple clicks.

A seamless connection between Salesforce and QuickBooks. With automation of key processes, this application works to eliminate manual and duplicative efforts to empower your team.

A seamless connection between Salesforce and QuickBooks. With automation of key processes, this application works to eliminate manual and duplicative efforts to empower your team.

Let's Get Started on Your Salesforce Project!

Salesforce

APPEXCHANGE

G2

USER REVIEWS