The Future of Banking

Jenna Trott

Jenna Trott

5 min read | June 28, 2022

Advancements in Technology

Why do advancements in technology matter for banks? If banks are not embracing and embedding next-gen tech, it will more than likely result in business stagnation and substantial loss in market share. How? Due to inflation, rapid recession and the Great Resignation, businesses and employees are now entering an economic crisis that’s resulting in significant gaps in the customer experience. A survey conducted in 2020 revealed that 75% of companies think they’re fulfilling their customer’s needs, when in reality only 30% of those customers actually agree. For an industry like banking, which is heavily reliant on client satisfaction, it is vital that they adapt their business models to these changing market trends in order to build lifelong customer loyalty. Compared to 2021, 85% of bank CEOs expect to spend more on technology in 2022 than in previous years. This would include enhancements like, banking APIs, intelligent forecasting, cloud computing, automation, embedded solutions, and cybersecurity. The time for creating more unified experiences is now and banks that are modernizing solutions will differentiate themselves from the banks that are not in 2022 and beyond.

Evolving Customer Expectations

Rapidly changing economic conditions means rapidly changing customer expectations. Now, customers expect the experiences in their financial lives to be as easy and engaging as they would be with Netflix, Amazon or Uber. A recent Salesforce report surveyed 15,000+ respondents globally and determined that 84% of customers say that being treated like a person, not a number, is very important in securing their business, yet, only 34% of companies treat customers or members as unique individuals.The future success of banks and credit unions will largely be determined by their ability to anticipate client needs despite changes in economic conditions. And those that are able to meet those expectations? Studies show that banks and CUs that focus on customer or member centric culture are 60% more profitable than those that do not. The time is now to begin assessing tech opportunities to identify the necessary operating models to stand out from the competition.

A New Wave of Competition

In many ways, COVID-19 served as the catalyst for change in the way we conducted business, with more services moving to a permanent digital medium than ever before. As of 2021, 71% of all Americans look primarily to online and mobile channels for their banking needs, making agility that much more important in the banking industry. Further, global cashless payment volumes are set to increase by more than 80% in the next few years alone making alternative banking methods a vital component for customer’s requirements when choosing a bank. But perhaps the biggest threat of all is that by 2025, the FDIC projects that 20% of the US population will hold accounts at non-banks. Now, it is paramount for banks to recapture the attention of existing and potential customers by improving CX, UX and personalization.

2022 Industry Requirements

Today, more than 88% of consumers said banks should have seamless communications and interactions across all channels. This means that banks should not only be providing connected experiences but should also streamline operations and optimize workflows. However, key obstacles like data disconnect and outdated banking systems get in the way of achieving this. The question that remains is what can those in the banking industry do to not only overcome these challenges but also ensure long-term success?

How Salesforce Can Help

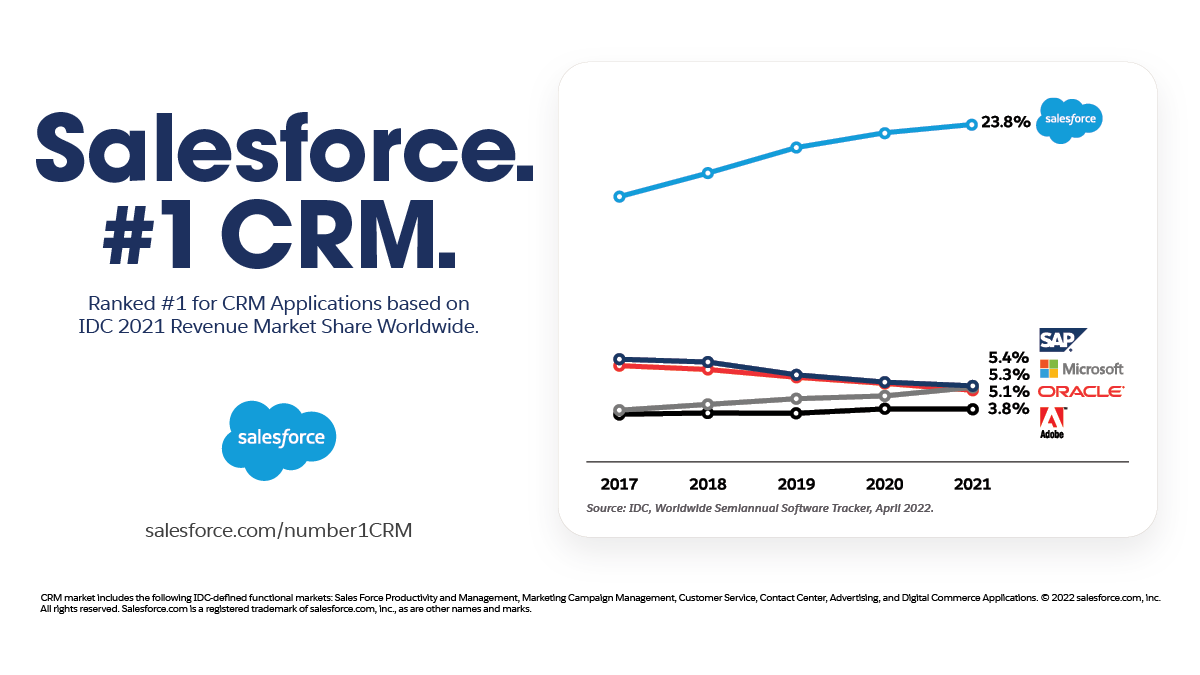

The future of banking calls for three critical factors: new technology, enhanced customer experiences and integrations and insights. There’s a reason Salesforce has been named the world’s #1 CRM for the ninth consecutive year, and it isn’t just because it satisfies those three requirements. With the world in a recession comparable to that of Depression Era economics, we must continue to seek out new ways to work. And unlike many big name businesses that puts every person for themselves, Salesforce believes that any crisis faced, is one that will be faced together. Here’s how bankers can leverage Salesforce to transform their org and better meet the expectations of their clients.

Technology

Salesforce provides purpose-built solutions for Corporate Banking, Investment Banking, Commercial Banking, Retail Banking and Mortgage & Lending. Built on the cloud, Salesforce for banking is designed to meet organizational needs and is industry compliant. Premier security technology ensures that client information is protected at every stage of their journey. And while other CRMs can take months or years to set-up, Salesforce can be complete in a matter of weeks with clicks not code.

Enhanced Customer Experiences

Easily unify digital channels to connect your contact center and provide streamlined customer services to clients. Whether connecting in-person or online, facilitate real-time collaboration from anywhere to ensure that they’re getting help from the right agent at the right time. And when lines-of-business gaps are closed, reps have access to valuable information for meaningful engagements and need anticipation, allowing you to transform leads to life-long loyalty.

Integrations & Insights

Modernize the banking experience with intuitive client insights such as interaction histories, relationship mapping, and AI-powered recommendations. An integrated view of relevant data enables bankers to move forward with confidence. Further, optimize all work processes with intelligent automations that can save you up to 109 billion hours of work.

It’s easy to feel out of control in such trying economic times and with fewer than 20% of customers saying their needs are being met, it’s more critical than ever to ensure that your business is prioritizing client needs. Salesforce solutions for banking places the power back in your hands, allowing you to evolve alongside your customers with agility. Whether you’re in retail, commercial, corporate or investment banking, close the gaps and make your bank the bank they trust.

To get started on your digital transformation journey with Salesforce for Banking, click here.

Get the latest Salesforce news

Subscribe to get the latest Salesforce blogs, guides, industry reports, events, and all things Salesforce related!

FREE Salesforce Assessment!

To demonstrate confidence in our ability as Salesforce Partners, we’re offering you the a FREE Salesforce Organizational Assessment.

Schedule Today!

Salesforce

PLATINUM

PARTNER

Salesforce

APPEXCHANGE

G2

USER REVIEWS