Bridging the Divide: How Salesforce Consultants Fill Gaps in the Insurance Industry

by Jenna Trott and Tremaya Reynolds | FEBRUARY 29, 2024 | 5 Minute Read

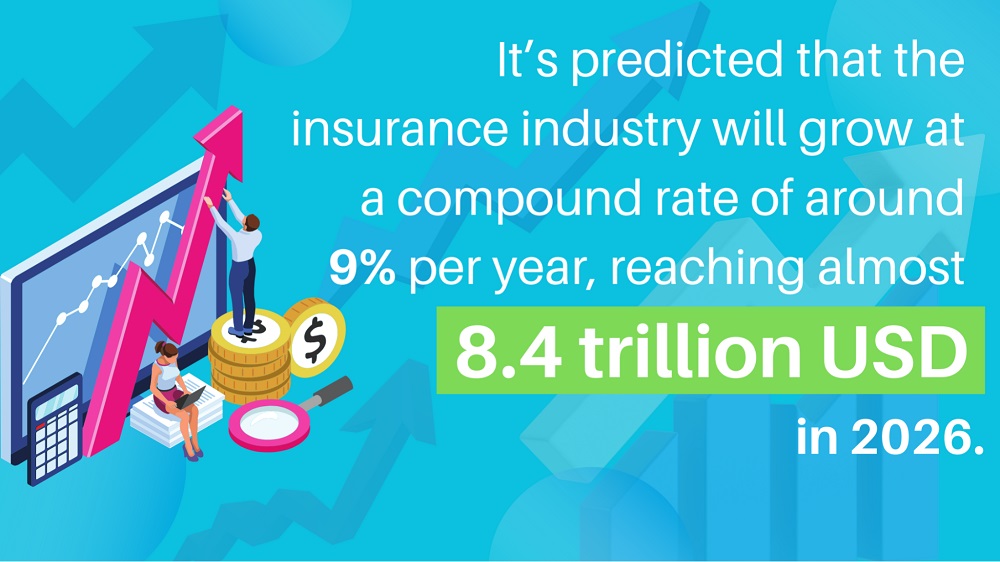

In today’s tech-driven, hyper-competitive world, time is more precious than ever. Insurance customers, like individuals across all industries, have little patience for cumbersome technology, extended wait times, and the frustration of being transferred from one call center agent to another. Combined with fast digital changes, AI, data use, and expected insurance market growth, it’s easy to see why insurers must focus on customer-centric solutions in order to future-proof their businesses.

By leveraging the power of Salesforce, insurance companies can streamline data, improve the customer journey, and foster revenue growth, to name just a few benefits. However, finding individuals with the unique skills and experience to tackle these as well as other critical needs in the industry can be challenging. Let’s learn more about the challenges within the insurance industry and how Salesforce consultants play a key role in bridging those gaps.

Challenges Shaping the Insurance Landscape

As the insurance industry navigates the post-pandemic landscape, looming on the horizon are new and old challenges, including:

Cyberattacks and Data Breaches

Cyberattacks and data breaches wreak havoc on insurance companies, inflicting financial losses, eroding trust, triggering costly regulatory fines, and exposing them to legal suits. The recent surge in sophisticated attacks within the industry serves as a stark warning of the mounting danger—companies lagging in modern technology adoption risk potential exposure and disaster.

Technology Disruption

Modern technologies like AI, machine learning, and blockchain are revolutionizing the insurance industry, with applications in personalized risk assessment, automated claims processing, and fraud detection. To stay ahead, insurers must actively embrace these technologies. Insurers who successfully navigate these transitions will likely outperform competitors in the future. However, knowing exactly where to start with integrating modern technologies can be a challenge as failed integrations can prove detrimental to the entire company.

Regulatory Compliance Changes

Navigating the ever-evolving regulatory landscape in insurance is a tightrope walk. Failure to comply can result in significant fines, reputational damage, and even license revocation. Staying ahead of changing regulations and legal actions requires constant adaptation, adding complexity and potential delays to innovation.

Economic Instability

Rising interest rates are a double-edged sword for insurance companies. On the one hand, regulators will scrutinize investments and reserves more intensely. On the other hand, economic downturns triggered by these changes can lead to lower demand for policies, increased cancellations, and reduced investment returns, greatly impacting profitability.

How Can Salesforce Help the Insurance Industry?

The true efficacy of any tool lies in its ability to address real-world challenges and meet specific needs effectively. Salesforce’s agile solutions and focus on customer experience empower insurance companies to not only grow but thrive in today’s ever-changing landscape. Benefits of insurers leveraging Salesforce include:

- Enhanced Customer Engagement

- Improved Operational Efficiency

- Data-Driven Insights

- Scalability and Flexibility

- Compliance and Security

- Integrated Ecosystem

These are just a few of the many benefits that exist for insurers using Salesforce. However, its true potential is realized when leveraged in tandem with Salesforce consultants who help take an already remarkable platform and fine-tune it for your company’s specific goals and requirements.

Fuel Your Success with Salesforce Consultants

In the ever-evolving landscape of the insurance industry, Salesforce consultants emerge as essential partners, offering specialized expertise that goes beyond the platform’s inherent benefits. Their strategic skill sets not only mitigate financial risks and operational challenges but also pave the way for tailored, seamless customer experiences, making Salesforce truly transformative for insurers.

Enhancing Customer Connections

In today’s competitive insurance landscape, building meaningful connections with customers is paramount for success. Salesforce consultants assist insurers in configuring Salesforce to deepen these relationships by:

- Ensuring that all interactions are tailored to individual needs and preferences, leading to more relevant and engaging experiences.

- Enabling insurers to swiftly address inquiries and resolve issues in real time, enhancing customer satisfaction and fostering trust in the process.

Skyrocket Conversions

Salesforce consultants work with insurers to boost conversions through personalized selling strategies that leverage Salesforce’s robust pipeline management. By harnessing this platform, consultants empower insurance teams to:

- Move beyond generic messaging to understand and address prospects’ unique needs and aspirations, forging deeper connections that drive conversion.

- Utilize Salesforce’s capabilities to deliver tailored messages and offers precisely when prospects are most receptive, increasing engagement and conversion rates.

Streamlined Claims, Policy, and Data Management

Salesforce consultants make streamlined claims, policies, and data management possible by seamlessly blending the robust capabilities of Salesforce solutions with their ability to deploy tailored solutions:

- Salesforce consultants improve communication channels for quicker and more efficient addressing of customer concerns.

- By leveraging Salesforce’s strengths and consultant deployment success, delays and manual tasks are minimized, ensuring clients receive support promptly.

- No more chasing paperwork. Teams work together effortlessly, ensuring smooth policy and data management.

Accelerated Workflow and Automation

By merging the robust capabilities of Salesforce solutions with Salesforce consultant’s ability to optimize systems to companies’ specific needs, workflows are streamlined and hyper-efficiency is achieved:

- Salesforce consultants can optimize workflows and automate repetitive tasks, enabling your team to accomplish more in less time by removing manual work and streamlining processes.

- As automated tasks become consistent and accurate, human error and the need for rework are reduced and even eliminated.

- With mundane tasks automated, your team is empowered to focus on higher-level responsibilities and what matters most.

Protect Your Business

Salesforce consultants can help guide your business against cyber threats, leveraging the platform’s robust security features and their deep expertise in data protection. They can:

- Identify and address vulnerabilities within your system before attackers exploit them.

- Implement robust security measures like access controls, data encryption, and intrusion detection systems.

- Develop a comprehensive security strategy tailored to your specific needs and regulations.

- Respond quickly and effectively in case of an attack, minimizing damage and downtime.

Stay Ahead

Emerging technologies like AI, big data, and machine learning are powering insurtech, offering innovative products and services that threaten to disrupt traditional models, but is your firm ready to adapt and thrive in this new landscape? Salesforce consultants can help your business:

- Streamline processes, personalize customer experiences, and gain valuable insights with AI-powered tools like Einstein Analytics.

- Make data-driven decisions to optimize pricing, risk assessment, and fraud detection.

- Suggest relevant products, services, and content based on individual customer needs and preferences.

Navigate Regulatory Compliance & Requirements

The ever-changing regulatory landscape can be a minefield for insurance companies. However, Salesforce consultants can help provide your business with:

- Ensuring your Salesforce platform is optimized for compliance, minimizing risk, and maximizing data quality.

- Synching essential third-party apps and channels, creating a unified compliance ecosystem.

- Streamlining the automation of critical data for compliance reporting, saving you countless hours.

Thrive Even in Uncertain Economic Times

- In a challenging economic climate, a powerful, scalable CRM is your competitive edge. Partner with Salesforce consultants to:

- Build a CRM that grows with your business, not against it, handling increased sales volume and evolving needs.

- Streamline processes and automate tasks, freeing up resources to focus on maximizing sales.

- Leverage analytics to identify valuable insights, helping you make strategic decisions.

With their specialized expertise, consultants are guiding insurers in customizing Salesforce solutions that align with their unique needs and challenges. From streamlining claims processing and policy management to deepening customer relationships and boosting conversions, consultants are instrumental in ensuring insurers fully leverage Salesforce to drive growth and innovation. By partnering with Salesforce consultants, insurers can navigate the complexities of Salesforce implementation with confidence, ultimately achieving greater efficiency, effectiveness, and success in today’s competitive insurance landscape.

Why AGG?

When it comes to selecting the right partner for technology integration and digital transformation, the experience of the company you choose is of utmost importance. Access Global Group is a Salesforce Summit (Platinum) level partner with nearly two decades of experience in Salesforce support, maintenance, and management services. Our team of certified experts knows Salesforce inside and out, meaning that when they come to you, no stone is left unturned and any conflicts are quickly addressed with agility and accuracy. With 5-star ratings on the Salesforce AppExchange and G2, our team offers a unique blend of global deployment expertise coupled with the agility of a boutique firm and a one-of-a-kind project methodology that places our clients at the forefront of every decision. Your successes are our successes, so we’re dedicated to providing solutions that align with your evolving requirements and aspirations.

We invite you to reach out to us with any questions or concerns regarding your Salesforce instance, we’d be happy to discuss a solution that best fits your needs at this time.

From proposals to quotes, contracts and more, Access Docs allows users to create and send consistent and accurate documentation to clients in a few simple clicks.

A seamless connection between Salesforce and QuickBooks. With automation of key processes, this application works to eliminate manual and duplicative efforts to empower your team.

A seamless connection between Salesforce and QuickBooks. With automation of key processes, this application works to eliminate manual and duplicative efforts to empower your team.

Get the latest Salesforce news

Subscribe to get the latest Salesforce blogs, guides, industry reports, events, and all things Salesforce related!

Let's Get Started on Your Salesforce Project!

Salesforce Innovations Transforming Insurance and Underwriting

At Access Global Group, we are committed to sustainability in every aspect of our operations. As a global leader in technology, specializing in remote work-from-home solutions…

Access Global Group Strategic Partnership With PeerIslands

At Access Global Group, we are committed to sustainability in every aspect of our operations. As a global leader in technology, specializing in remote work-from-home solutions…

Access Global Group Sustainability Annual Report

At Access Global Group, we are committed to sustainability in every aspect of our operations. As a global leader in technology, specializing in remote work-from-home solutions…

Digital Transformation Powered by Dedication & Expertise! Chat With Our Experts Today!