Jenna Trott | June 2, 2023 | 5 Minute Read

If you work within the insurance industry, then you know that the days of rigid and cumbersome work processes are long gone. The state of insurance today is an environment that is ever-shifting and evolving, demanding insurance carriers to be agile, adaptive, and constantly walking on the edge of innovation. Fueled by the relentless pursuit of extraordinary customer experiences, more and more insurance agencies are investing in digital solutions to better capture the needs and desires of their policyholders – making competition increasingly stiff. The insurance carriers that are reimagining traditional practices, transcending boundaries, and unleashing the full potential of digital transformation will be the carriers to stand out. So, in an oversaturated market where carriers of all sizes are dashing to the top, how can you stand out when the extraordinary has become the “new norm”? Today, we’ll discuss how Duck Creek’s innovations can redefine the future of the insurance industry and help your company grow exponentially.

Duck Creek Technologies – what do they do?

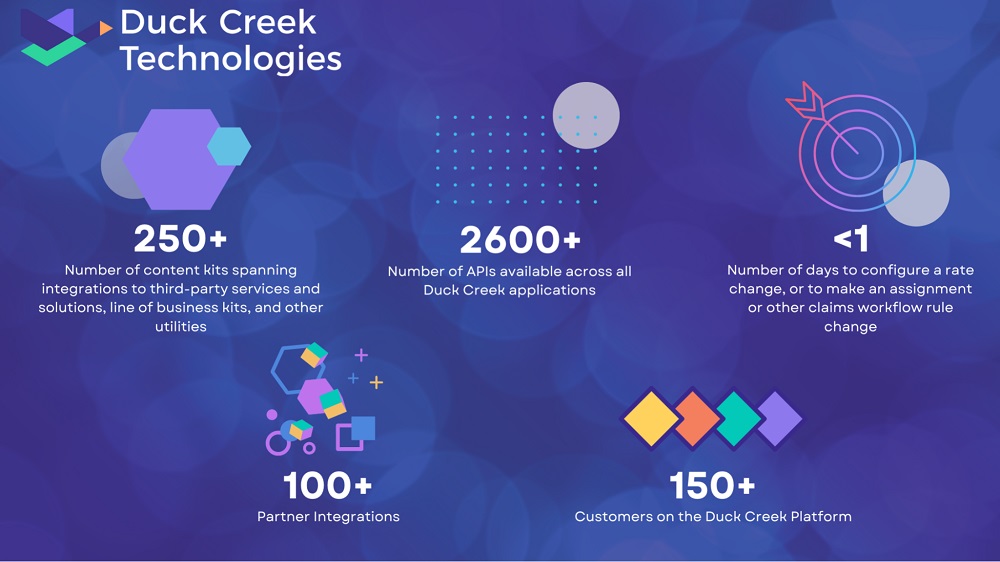

First things first, let’s dive into the visionary force that’s shaping the future of the insurance industry – Duck Creek Technologies. Serving as the foundation for cutting-edge insurance systems, it empowers the industry to harness the limitless potential of the cloud, fostering operations that are as agile as they are dynamic. Its comprehensive suite of capabilities offers the utilization of low-code configuration tools, enabling insurers to effortlessly tailor their systems to exacting specifications. With seamless integrations into the insurtech ecosystem, it opens doors for unparalleled collaboration and growth. The platform’s open APIs foster connectivity and facilitate the exchange of data, amplifying insurers’ capabilities within a thriving digital ecosystem. Further, the Duck Creek Platform promotes the development of future-ready solutions that place insurers firmly in the driver’s seat of change. By keeping software code separate from your IP, Duck Creek Technologies empowers carriers to retain complete control over a future where adaptability, innovation, and progress are at your fingertips.

Benefits of Leveraging Duck Creek

Duck Creek was created with the intention of remedying many of the challenges faced by insurance carriers today, including:

→ Rising market competition

→ Soaring operational costs

→ Regulatory compliance difficulties

→ Effective fraud prevention

→ Customer acquisition and retention

→ Claims management

– to name a few! By providing a unified suite of products, Duck Creek Technologies helps insurers eliminate redundant maintenance to achieve a single point of change. The Duck Creek Suite offers a complete end-to-end insurance solution, comprising industry-leading services that can be implemented together or independently of one another. It encompasses full-featured policy, rating, billing, and claims solutions – a necessity for insurance agencies. Growth in the insurance business comes with its own set of challenges, but wrestling with disparate systems should not be one of them. The Duck Creek Suite offers a seamless and unified experience, alleviating concerns about inconsistency, poor integration, and lack of transparency. It empowers insurers of all sizes to adapt swiftly, driving continuous improvement throughout the entire insurance lifecycle. By enabling businesses to independently configure rule changes, transact lines of business, and process claims more efficiently, the suite enhances customer service while reducing expenses and freeing up valuable resources for strategic IT projects. Built on a web-enabled, service-oriented, event-based architecture, the Duck Creek Suite provides off-the-shelf functionality that can support insurers of any size. Further, it remains poised to accommodate future innovations, ensuring your business stays ahead of the curve.

Benefits of Integrating with Salesforce

A Duck Creek Technologies and Salesforce integration offers an array of benefits that revolutionize the insurance landscape. In the fast-paced world we live in, staying ahead of the game requires a sales team that is not only dynamic but is accountable. That’s where the seamless integration of Duck Creek Technologies and Salesforce comes into play, revealing a wave of transformative benefits for insurance agencies. Imagine a world where your sales team is always in the know, armed with real-time insights and a comprehensive view of their leads, quotes, and policies. With Duck Creek and Salesforce integration, this becomes a reality. Gone are the days of manual data entry and cumbersome spreadsheets, instead, a unified platform empowers your team to effortlessly manage their sales pipeline and drive exceptional results. But it doesn’t stop there, this integration offers benefits for your policyholders too. By breaking down data silos and providing a holistic view of each customer, you can deliver personalized and tailored experiences at every touchpoint. The result is unparalleled customer satisfaction, increased retention rates, and a significant boost to your bottom line. And we can’t overlook the power of automation; by integrating Duck Creek and Salesforce, manual efforts are eliminated and your team is freed from the confines of repetitive, laborious tasks. Time is your most valuable resource and automation offers you critical hours back to focus on what truly matters – building relationships and closing deals. The result? Increased productivity, reduced errors, and a significant rise in ROI.

The Case of Luis

Encountering Bumpy Roads

Luis has had his new car for just over a year when his engine light came on and he’s begun to notice difficulty accelerating or maintaining speed. Fortunately for Luis, he has an extended car warranty policy with a reputable agency – whom he promptly calls. He immediately contacts a representative for assistance but is met with long wait times and frequent call transfers. Amidst the frequent phone call transfers, Luis begins to wonder if he should switch carriers – he’s feeling frustrated and left in the dark as there was no way to receive clear answers or obtain any updates on the status of his claim.

Turbocharged Transformations

Ultimately, Luis ended up switching to a carrier that was utilizing Salesforce and Duck Creek and the presence of these platforms made all the difference in his experience. With this new company, Luis encountered:

→ An improved quoting process through a user-friendly online portal where Luis could quickly enter and access crucial information. The integration of data sources and automated workflows resulted in accurate quotes within minutes, eliminating the need for lengthy communication exchanges.

→ A seamless policy management process where Luis has access to a personalized dashboard to easily view and manage policies in a single location. Any changes or updates, such as adding or removing vehicles, were effortlessly handled through intuitive self-service options, reducing the reliance on manual paperwork and phone calls.

→ Enhanced claims experiences where Luis could easily file claims online, submit the necessary documentation electronically, and track its progress in real-time. This level of transparency and self-service capabilities drastically reduced the time and effort required to resolve claims, providing Luis with a sense of confidence and assurance.

→ More personalized customer service thanks to Salesforce’s customer relationship management capabilities which provided agents with instant access to the policyholder’s complete history. This empowered them to address inquiries promptly and provide more tailored recommendations. The result? Luis felt valued and supported throughout the entire journey.

By transitioning to a company that leveraged the combined power of Salesforce and Duck Creek, Luis experienced a notable transformation in his insurance experience. The streamlined processes, self-service options, and personalized customer service provided significant time savings, reduced manual efforts, and improved overall satisfaction.

The AGG Advantage

In a time when exceptional experiences have become the new normal, your insurance agency deserves experiences of the same quality. When it comes to seamlessly integrating and optimizing leading platforms like Salesforce and Duck Creek, Access Global Group is a standout. As a 5-star rated Summit Salesforce partner, we bring a unique blend of expertise in both Salesforce and Duck Creek, coupled with a deep understanding of the insurance industry. Our team of in-house experts understands the ins and outs of the industry, its challenges, and opportunities, enabling a highly tailored integration and optimization process to meet the specific needs of the insurance agencies we serve. Whether it’s enhancing customer experiences, streamlining workflows, or driving operational efficiency, our experts know how to leverage Salesforce and Duck Creek to achieve a shorter time to value. And unlike other consultants, our work extends beyond the initial integration. We don’t simply integrate and deploy, we empower our clients with the knowledge and tools to fully leverage these platforms for sustained growth. Through comprehensive training and ongoing support, we ensure that our clients are well-equipped to navigate the future of the insurance industry and stay ahead of the competition.

So, why settle for anything less than exceptional results? Talk to us about the challenges you’re currently facing and we can offer solutions that will help you to not only overcome them but climb to new heights.

Get the latest Salesforce news

Subscribe to get the latest Salesforce blogs, guides, industry reports, events, and all things Salesforce related!

From proposals to quotes, contracts and more, Access Docs allows users to create and send consistent and accurate documentation to clients in a few simple clicks.

A seamless connection between Salesforce and QuickBooks. With automation of key processes, this application works to eliminate manual and duplicative efforts to empower your team.

A seamless connection between Salesforce and QuickBooks. With automation of key processes, this application works to eliminate manual and duplicative efforts to empower your team.

Let's Get Started on Your Salesforce Project!

Salesforce

PLATINUM

PARTNER

Salesforce

APPEXCHANGE

G2

USER REVIEWS