How to Profit from Your Contact Center

Jenna Trott

Jenna Trott

5 min read | OCTOBER 12, 2022

The Inbound Call Agent

Inbound call agents already do a great job routing and referring phone calls, but what if there was a way to further simplify this process?

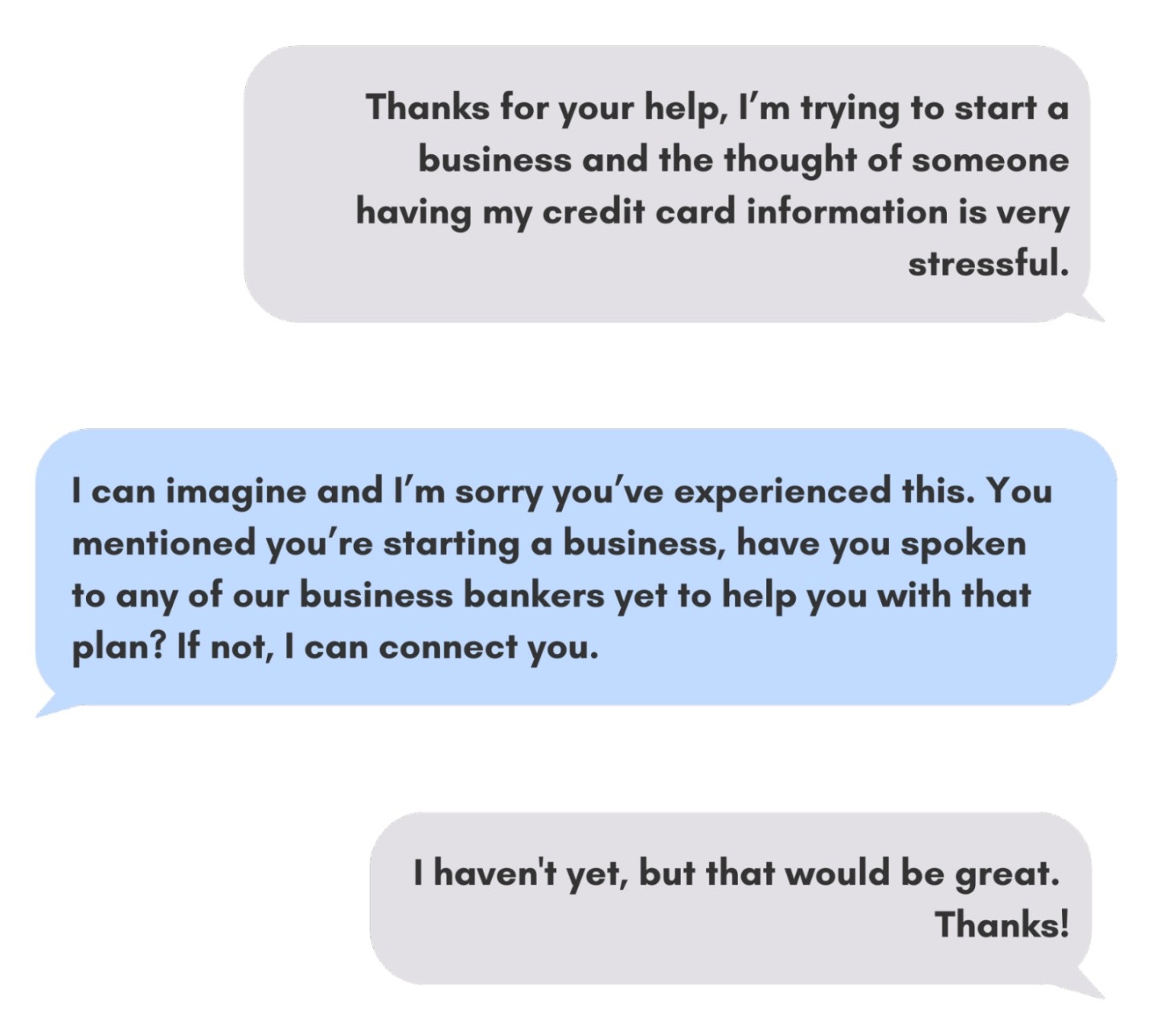

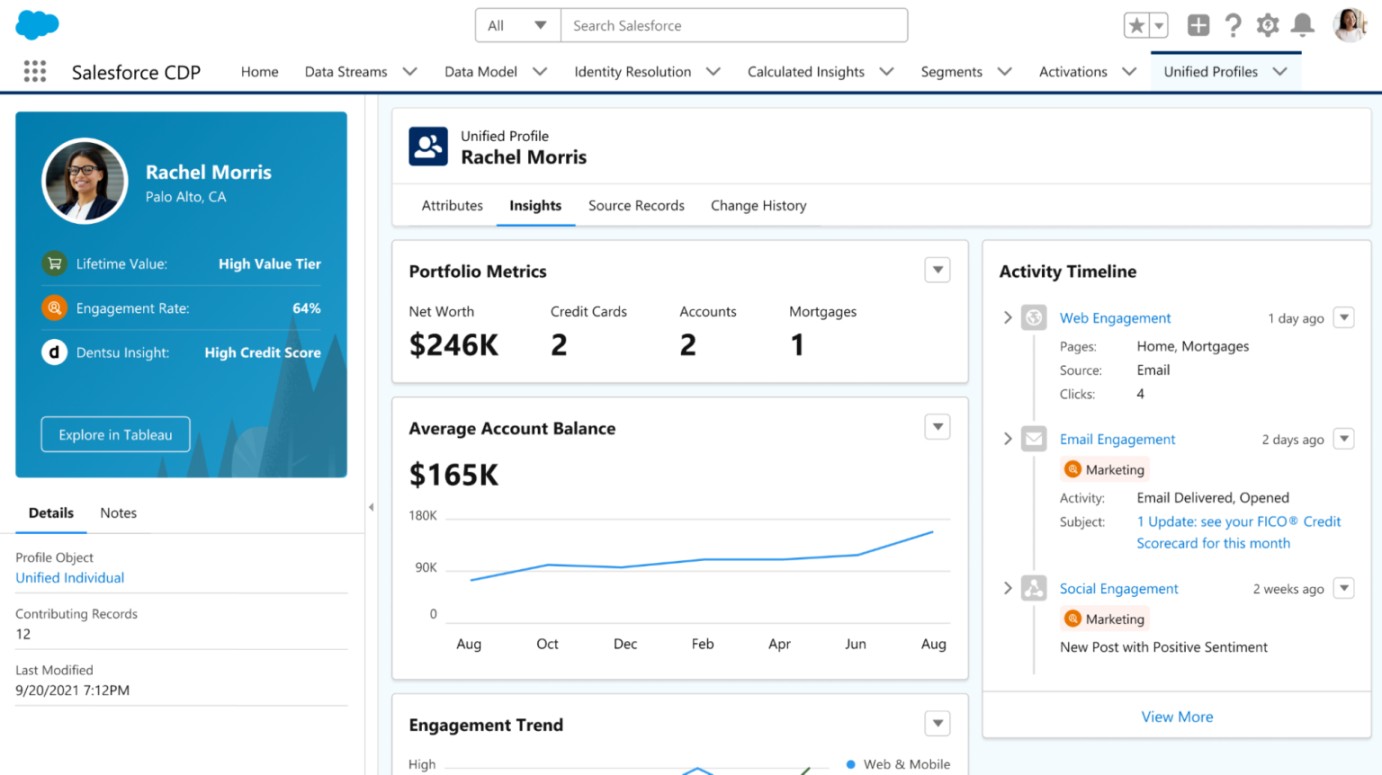

Picture this: your bank gets a phone call from Jane Smith, who is concerned because there’s been a $200 charge on her card and she needs assistance disputing the transaction. Traditionally, this can be a laborious and time intensive process; but with Salesforce, everything your agents need to better serve Jane is readily available at their fingertips. Salesforce displays a comprehensive timeline of clients, tacking every interaction, opportunity, lead and case that Jane has had with your bank. Further, the agent will be able to access critical information from transcribed calls, call recordings, and a detailed client profile via Customer 360 that paints a full picture of who you’re trying to assist. This not only helps to personalize the experience for customers, but it also enables faster resolution times by triggering automation directly from Salesforce for a full end-to-end business process.

Outbound Calls

When we combine service with sales, we can utilize Salesforce and Financial Services Cloud to enhance experiences for the client and upskill and empower your agents to begin making outbound phone calls. Salesforce helps financial institutions achieve what they consider are the “3 V’s” of outbound phone calls: volume, velocity, and value. Instead of waiting for inbound phone calls, your bank can be more proactive by dialing customers, here’s how.

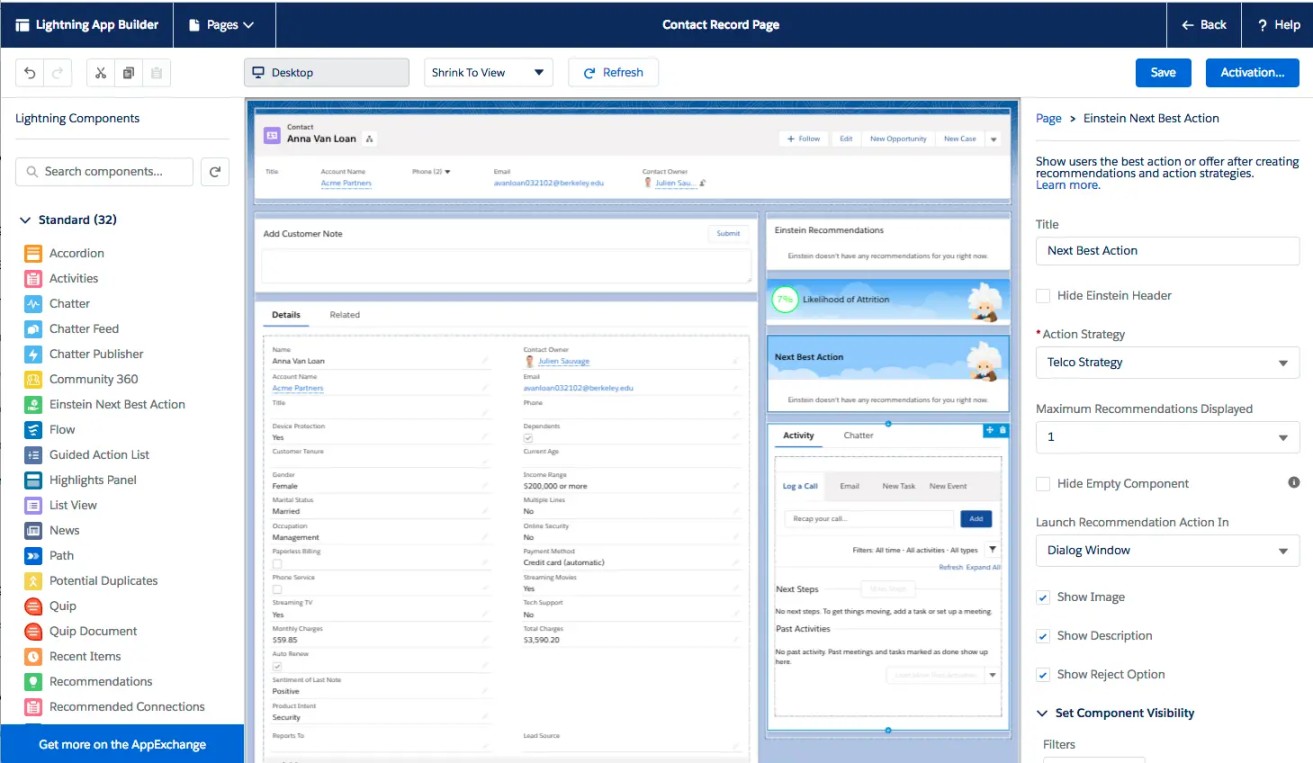

Salesforce’s same automation, intelligence and real time capabilities for inbound calls come together to simplify outbound calling. Automation works to create leads and funnels them directly into your Salesforce instance. It creates specific lead types based on customer profiles and lead scores. Once those leads come in, your bank can use auto-generated sales cadences to outline what you can do for this customer in your initial point of contact as well as guides for follow up interactions as well. This helps to shift your focus away from outreach over to velocity and how quickly you can start calling these customers. In just one click agents can dial the customer and the call script loads on the same screen. It then becomes incredibly easy to manage what’s triggered that lead score, what’s happening on the lead score, as well as seeing the stage of the lead and what the next best interactions are going to be for that customer.

Salesforce Call Center Use Case

A bank approached Salesforce with a serious dilemma: they recently underwent a merger and now they have to call 400,000 customers in a 9 week timeframe. Further, this bank needed all of their retail bankers making these outbound calls, but the problem with that was they were averaging around 1,000 calls per week and the contact rate was only 13%. Using automation, intelligence and real-time data, Salesforce was able to create a targeted list of customers that reduced the original number of 400,000 to just 250,000 in order to generate the highest impact. Salesforce routed these targeted leads directly into the instance and auto-generated cadences for reps to follow, helping the retail bankers focus less on who to call and what to say and focus more on calling large numbers of clients. Using this method those same retail bankers who previously were making around 1,000 calls a week were able to make 236,000 calls in 9 weeks with a 45% contact rate. They also were able to generate an additional 6 millions dollars in deposit growth in the first 30 days of the campaign. This not only significantly streamlined efforts, but resulted in this bank saving substantial amounts of time and money as well.

In banking, the stakes are high and if your call center is unable to handle the volume of calls received, the effects can be detrimental for your institution. Studies show that Salesforce can increase loan sales by 29 percent while helping to cut costs associated with repetitive administrative tasks. The long short of it is that with Salesforce; everyone wins: your agents with easy conversions and smoother pipelines and your clients with personalized care and faster resolutions. What are you waiting for? Stop juggling data and start closing deals today.

Get the latest Salesforce news

Subscribe to get the latest Salesforce blogs, guides, industry reports, events, and all things Salesforce related!

FREE Salesforce Assessment!

To demonstrate confidence in our ability as Salesforce Partners, we’re offering you the a FREE Salesforce Organizational Assessment.

Schedule Today!

Salesforce

PLATINUM

PARTNER

Salesforce

APPEXCHANGE

G2

USER REVIEWS