5 Ways to Modernize the Agent and Broker Experience

Jenna Trott

Jenna Trott

5 min read | OCTOBER 07, 2022

Experts have been tracking industry trends since the onset of the pandemic and what they’ve found are signs pointing to digital adaptation becoming a necessity. In fact, 50% of the global workforce is predicted to become remote workers, making it necessary for companies to onboard and manage customers virtually. So, what does this mean for those working in the financial services industry? Well, more so than ever before customers want flexibility, with 62% of them saying online capabilities are important when selecting a financial services institution. Digital experiences are no longer something that’s desired – it’s to be expected by your customers. Thus, modernizing processes within the financial services sector becomes essential – but how can we get there? Here are 5 ways to modernize the agent and broker experience with Salesforce.

Unified System

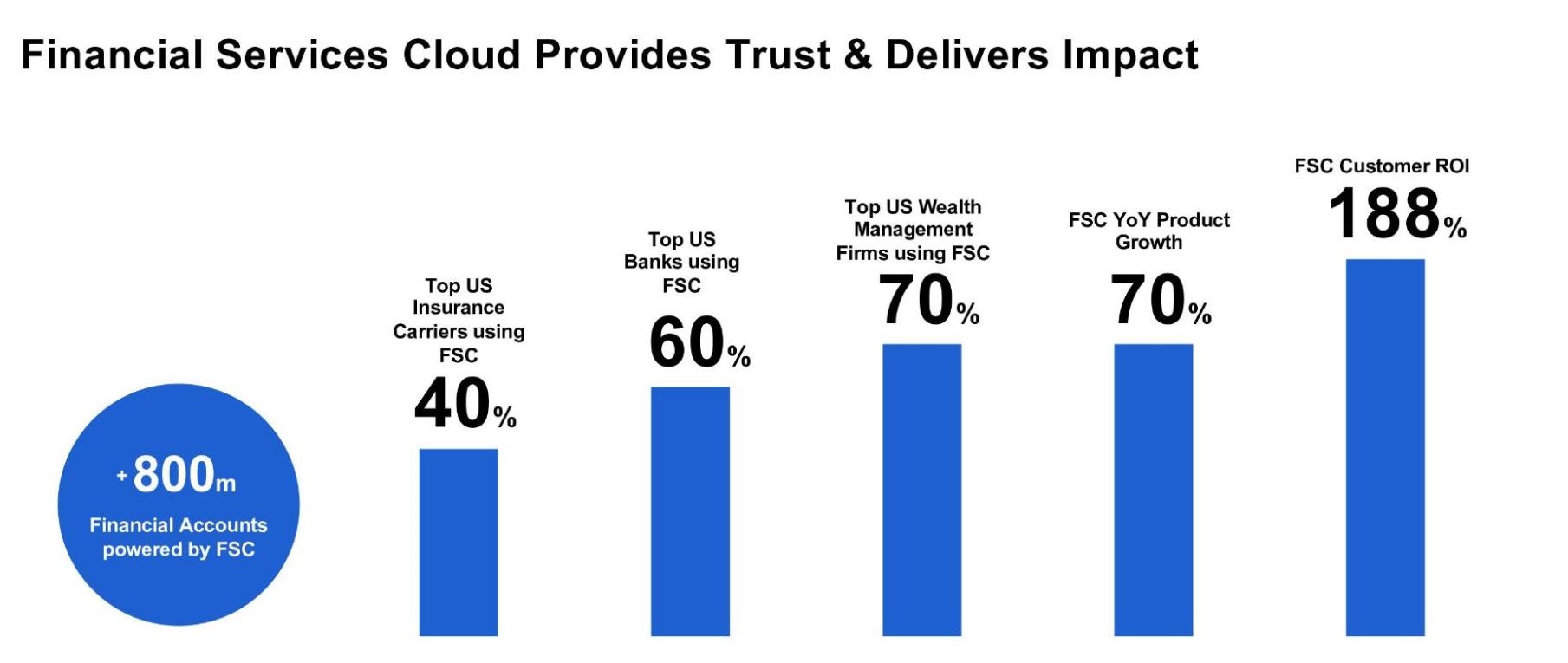

In a study conducted by Salesforce, it was found that 75% of consumers look for a consistent experience across multiple channels, but traditionally, that is not the experience that is received. Oftentimes within financial service industries, critical client information is housed in one system and wealth information is stored in another, which ultimately leads to many swivel-chair inefficiencies. And when employees are stuck swiveling between different software platforms to find solutions? Well, the firm loses valuable time that could be otherwise spent investing in customer relationships. Having unified systems and processes fuel employee success by creating a more productive team to deliver better customer engagements. How can you achieve a unified system? Salesforce’s Financial Services Cloud works to alleviate many inefficiencies with robust integrations that align with a number of leading fintech software solutions to create a single, comprehensive view of each policyholder. With a unified system, you and your prospects can decrease the amount of time wasted toggling between different platforms to instead collaborate in real time and solve cases faster.

360 Degree View of the Client

In addition to utilizing the power of Financial Services Cloud to create a more unified system, you can also use it to build a 360 degree view of your clients. This coupled with CRM Analytics enables you to create, visualize and act on key client, household and relationship information to make moments matter and generate customer loyalty. People who take advantage of CRM Analytics see benefits like: 38% faster decision making capabilities, 22% increase in productivity and a 14% increase in sales conversions. Transitioning to a more digital model doesn’t mean that you have to compromise the quality of your client relationships, in fact Financial Service Cloud and CRM Analytics can help to personalize client relationships at scale. Use key data to better understand who your clients are, what they have, and what they need. Plus, “Interest Tags” help unlock client interests and facilitate personal connections to further drive agent & broker productivity.

Productivity Tools

Speaking of productivity, there are a lot of ways Financial Services Cloud and other Salesforce products can help to maximize efficiency for brokers and agents. Automation is perhaps one of the easiest ways to simplify otherwise time consuming tasks and with Salesforce, it can save you 109 billion hours of work a month. For agents and brokers automating things like: the discovery questions process, manual document review, client onboarding, and risk and compliance assessments, prove to be critical in simplifying work processes and can drastically reduce errors resulting from manual efforts.

Intelligent Analytics

Data is incredibly important for businesses; not only to help pivot quickly and adapt to changing market conditions, but also to empower agents & brokers, to better inform, market and sell to clients in a personalized way. Salesforce products can help you get the most out of your data by giving you the ability to extract information from any source and automatically analyze hundreds or thousands of rows of information. Brokers and agents can then leverage these insights from easy to read visuals without ever having to leave Salesforce, helping to answer your business’s most critical questions and provide key insights into areas like Portfolio Performance, Lead Conversion and Customer Retention. Further, companies that are data driven see benefits like: a 41% improvement in production time to market and an 89% increase in customer retention and acquisition.

Modern Marketing

When you have a unified platform, a 360 degree view of your clients, are more productive and make data backed decisions, agents and brokers can upsell products and services more intelligently, and effectively. This is achieved by enabling easy access to rich customer journeys across multiple channels like email and mobile. One of the biggest concerns with digital transformation within financial services is remaining compliant and secure but Salesforce’s premier industry solutions are built with state of the art security layered throughout, so you focus on innovation while your system supports industry specific regulations.

How does this create value for agents and brokers

There are four key ways that Salesforce solutions provide value for agents and brokers:

Increase Client Retention:

- Keep customers engaged with high quality, low effort marketing

- Easily leverage best practices for onboarding and re-engagement, to help keep customers interested, engaged and reduce attrition

Increase Upsell Opportunities:

- 360 degree views of clients help to deepen relationships and identify product or service upsell opportunities

- Utilize automation increase the number of customers you can see and “wow” them with personalized touchpoints

Increase Productivity:

- Prevent platform hoping by embedding marketing and analytics tools in agents/brokers existing workflows

- Utilize automation to eliminate repetitive or duplicative work efforts

Increase Compliance:

- Send content through an internal review process based on modifications/target audience size

- Automatically disable sending when certain words are detected, like “guarantee” or “promise”

Need help implementing salesforce solutions that can modernize the agent and broker experience? Talk to us! Access Global Group is your premier Salesforce Consulting Services & Managed Services experts. With over 15 years in the industry, Access Global Group has become Summit-Level partners with 5-star ratings on G2 and the Salesforce AppExchange. AGG has over 250 Salesforce certifications and have successfully completed 500 Salesforce integrations and over 1,500 Salesforce projects throughout five different countries. Ask how we can leverage our to meet your unique needs and generate real change within your financial institution.

Get the latest Salesforce news

Subscribe to get the latest Salesforce blogs, guides, industry reports, events, and all things Salesforce related!

FREE Salesforce Assessment!

To demonstrate confidence in our ability as Salesforce Partners, we’re offering you the a FREE Salesforce Organizational Assessment.

Schedule Today!

Salesforce

PLATINUM

PARTNER

Salesforce

APPEXCHANGE

G2

USER REVIEWS