Securing Success: Compliance and Security in Insurance Sales with Salesforce

Jenna Trott | APRIL 12, 2024 | 5 Minute Read

As one of the leading customer relationship management (CRM) platforms, Salesforce has addressed this challenge, becoming an indispensable tool for insurance companies seeking to streamline operations, enhance customer experiences, and uphold regulatory standards. Let’s take a look at how insurers are leveraging Salesforce to not only navigate this complex environment but master it.

Navigating Compliance and Security Challenges

The importance of compliance and security within insurance cannot be overstated. Whether it’s adhering to fair sales practices, disclosing vital information, or implementing anti-fraud measures, compliance is the cornerstone of ethical business conduct. Similarly, security measures safeguard sensitive customer data from breaches and unauthorized access, preserving privacy and financial integrity.

Complex and constantly evolving, navigating this regulatory landscape requires a deep understanding of its intricacies. This can be a challenge for insurance salespeople who often face pressures to meet sales targets and quotas. Consequently, they may prioritize sales over compliance and security measures.

Given how handling sensitive customer information is a critical responsibility for insurance salespeople, here are some key best practices that ensure the protection of customer data:

Data Encryption: Utilize encryption techniques to help protect sensitive customer information both in transit and at rest. This ensures that even if data is intercepted, it remains unreadable to unauthorized parties.

Secure Storage: When storing sensitive customer data, ensure it’s safeguarded within secure databases or systems with restricted access, bolstering security measures with robust authentication methods like multi-factor authentication to fortify controlled access to customer information.

Limited Access: By restricting access to customer data to essential personnel and instituting routine reviews and updates of access permissions, companies can further fortify their defenses, ensuring that only authorized individuals can access sensitive information.

Training and Awareness: Providing comprehensive training on data security to your entire team, especially your salespeople, ensures secure data handling and sharpens their ability to detect and prevent scams. Further, this proactive approach builds trust, strengthens client relationships, and enhances business success.

Secure Communication: Tap into the strength of secure communication channels like encrypted email or secure messaging platforms to transmit sensitive customer information, avoiding unsecured channels like standard email or text messages to ensure the utmost protection and confidentiality of data.

Data Minimization: Gather and retrain solely the essential customer information required to meet business objectives, refraining from retaining unnecessary or excessive personal data that could potentially jeopardize security if compromised.

Data Disposal: Implement meticulous procedures for securely disposing of customer data that has outlived its purpose, including the permanent deletion of digital records, while diligently adhering to data retention and disposal regulations to safeguard confidentiality and maintain regulatory compliance.

Incident Response Plan: Develop and regularly update an incident response plan to effectively manage and mitigate the impact of data breaches or security incidents involving sensitive customer information. This plan should outline steps for containing the breach, notifying affected parties, and cooperating with regulatory authorities.

By following these best practices, your insurance sales team can play a key role in safeguarding the confidentiality, integrity, and security of sensitive customer information. However, as previously mentioned, maintaining stringent protocols can pose challenges, especially when striving to meet or exceed sales targets and quotas. This is where Salesforce emerges as a key ally. How? Let’s take a closer look.

The Salesforce Solution: Data Security and Compliance

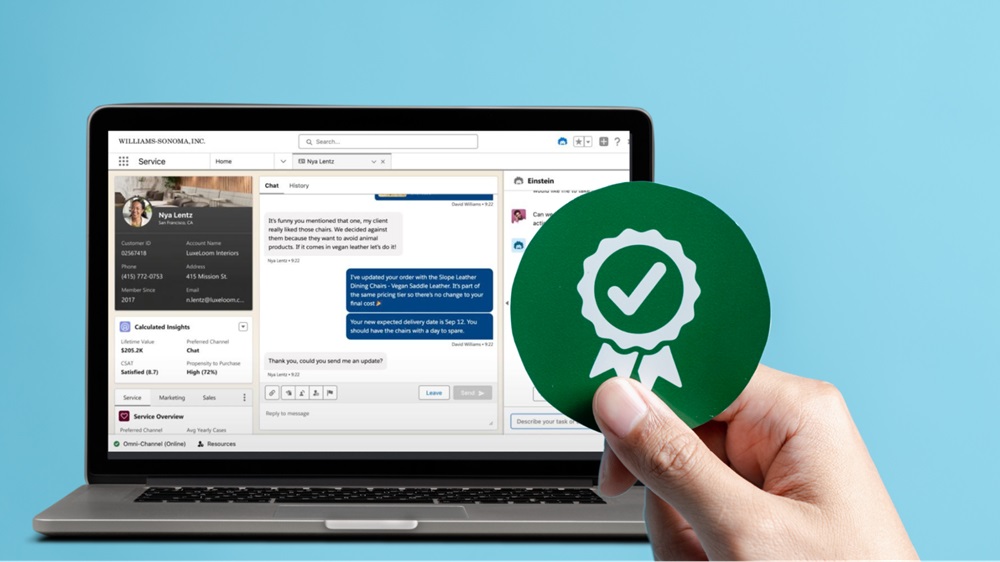

One of the primary concerns in the insurance industry is safeguarding customer data. Salesforce tackles this challenge head-on by employing industry-standard encryption and robust access controls. These measures preserve both data integrity and confidentiality, offering peace of mind to both the insurance company and its customers.

Data Security and Compliance in Salesforce

Salesforce’s compliance capabilities extend to various global privacy regulations such as the General Data Protection Regulation (GDPR). By providing tools to manage data subject rights, consent, data retention policies, and permissions, Salesforce ensures that insurance companies can achieve and maintain GDPR compliance seamlessly. Check out Salesforce’s full list of compliance certifications here.

Audit Trail and Data Governance in Salesforce

Highly intuitive, Salesforce’s system maintains an audit trail logging user activities, data access, and system changes. This feature enables insurance providers to easily track and monitor data modifications, fostering accountability, and supporting compliance audits.

Salesforce also allows insurance companies to define data governance policies. These policies may include data classification, access controls, and data sharing rules, all instrumental in maintaining data integrity and achieving compliance with both internal policies and external regulations.

Salesforce’s Industry-Specific Compliance Solutions

Industry-specific compliance solutions within Salesforce are designed to address regulatory requirements in various sectors. For instance, in the financial industry, Salesforce Financial Services Cloud supports compliance with regulations like the Financial Industry Regulatory Authority (FINRA) and Federal Deposit Insurance Corporation (FDIC). These solutions offer pre-configured features and workflows, simplifying the path to regulatory compliance for insurance companies.

Centralized Systems with Salesforce

Superior integration capabilities allow Salesforce to work seamlessly across systems. This centralized monitoring and management of compliance activities across multiple systems reduces the likelihood of missing critical vulnerabilities, making Salesforce a smart choice for insurance companies.

Compliance in Mergers and Acquisitions

Mergers and acquisitions frequently entail intricate compliance matters. Salesforce streamlines these processes by automating tasks, enhancing transparency, and enabling seamless data sharing and collaboration, thereby optimizing efficiency and effectiveness.

RFP Submission and Compliance

The Request for Proposal (RFP) submission process can be confusing, Salesforce eliminates ambiguity by making the process more transparent and trackable. This feature is vastly beneficial for compliance as it ensures all steps are documented and easily accessible.

Building Stronger Customer Connections

By prioritizing compliance with regulatory requirements and implementing robust security measures, insurance companies demonstrate their commitment to protecting client data and ensuring transparency in their operations. This instills an unparalleled level of trust for clients, knowing that their personal and financial information is handled carefully and meticulously. Let’s see how this manifests in the case of Sarah.

Meet Sarah

Sarah is considering purchasing a life insurance policy though she has some concerns about sharing sensitive personal and financial information and wants validation that her data will be handled securely. She decides to reach out to an insurance company that is currently leveraging Salesforce with robust security measures in place and has a strong reputation within the community.

Sarah visits their website and fills out a contact form expressing her interest in a life insurance policy. Shortly after, she receives a personalized email from an insurance agent, David, who has access to Salesforce’s secure platform. David introduces himself and offers to schedule a video call to discuss Sarah’s insurance needs further. Impressed by the quick response and personalized attention, Sarah agrees to the video call.

Sarah appreciates the ease of accessing and reviewing the policy documents online and is impressed by the level of security implemented by the insurance company. Feeling reassured and well taken care of, Sarah decides to proceed with purchasing the life insurance policy through the insurance company. She appreciates the seamless experience and the company’s commitment to security and compliance, making her feel confident in her decision to entrust them with her insurance needs.

Salesforce Security and Compliance Success

Salesforce provides an all-encompassing solution for insurance companies to navigate the complex world of compliance and data security. However, knowing how to appropriately configure it to industry standards and regulations remains a challenge for some. Salesforce consultants offer optimization solutions unique to each insurer, adding an additional layer of security and compliance so the insurer can focus on what they do best – serving their customers and community.

This is where we come in. Access Global Group is a Salesforce Summit (Platinum) level partner with nearly two decades of experience in Salesforce support, maintenance, and management services. We’ll conduct assessments of your currently existing security measures and identify potential vulnerabilities or areas for improvement. We’ll work with you to implement advanced security configurations and access controls to ensure that sensitive data is protected from unauthorized access or breaches.

Furthermore, we offer comprehensive training and ongoing support to insurance teams, empowering them to navigate security protocols confidently and adhere to compliance standards. Whether you’re looking to customize Salesforce functionalities to streamline compliance processes, automate regulatory reporting, enforce data governance policies, or get a better understanding of your current compliance and security measures, our team of 5-star rated consultants can help.

We invite you to reach out to us with any questions or concerns regarding your Salesforce instance, we’d be happy to discuss a solution that best fits your needs at this time.

From proposals to quotes, contracts and more, Access Docs allows users to create and send consistent and accurate documentation to clients in a few simple clicks.

A seamless connection between Salesforce and QuickBooks. With automation of key processes, this application works to eliminate manual and duplicative efforts to empower your team.

A seamless connection between Salesforce and QuickBooks. With automation of key processes, this application works to eliminate manual and duplicative efforts to empower your team.

Get the latest Salesforce news

Subscribe to get the latest Salesforce blogs, guides, industry reports, events, and all things Salesforce related!

Let's Get Started on Your Salesforce Project!

Salesforce Innovations Transforming Insurance and Underwriting

At Access Global Group, we are committed to sustainability in every aspect of our operations. As a global leader in technology, specializing in remote work-from-home solutions…

Access Global Group Strategic Partnership With PeerIslands

At Access Global Group, we are committed to sustainability in every aspect of our operations. As a global leader in technology, specializing in remote work-from-home solutions…

Access Global Group Sustainability Annual Report

At Access Global Group, we are committed to sustainability in every aspect of our operations. As a global leader in technology, specializing in remote work-from-home solutions…

Digital Transformation Powered by Dedication & Expertise! Chat With Our Experts Today!