The Ultimate Partnership: Encompass and Salesforce Revolutionize Loan Origination

Jenna Trott

Jenna Trott

5 min read | AUGUST 18, 2023

For financial institutions, the shift towards digital transformation is no longer a choice, but a strategic imperative. In a world where convenience, personalization, and real-time interactions have become the norm, embracing digital innovation isn’t just an option; it’s the gateway to unlocking new levels of efficiency.

Overwhelmed? Don’t be. There’s a solution that takes shape in the form of integrating Encompass and Salesforce to not only deliver significant ROI and lasting customer experiences, but it also gives your company the tools it needs to weather even the harshest market storms.

Encompass – what does it do?

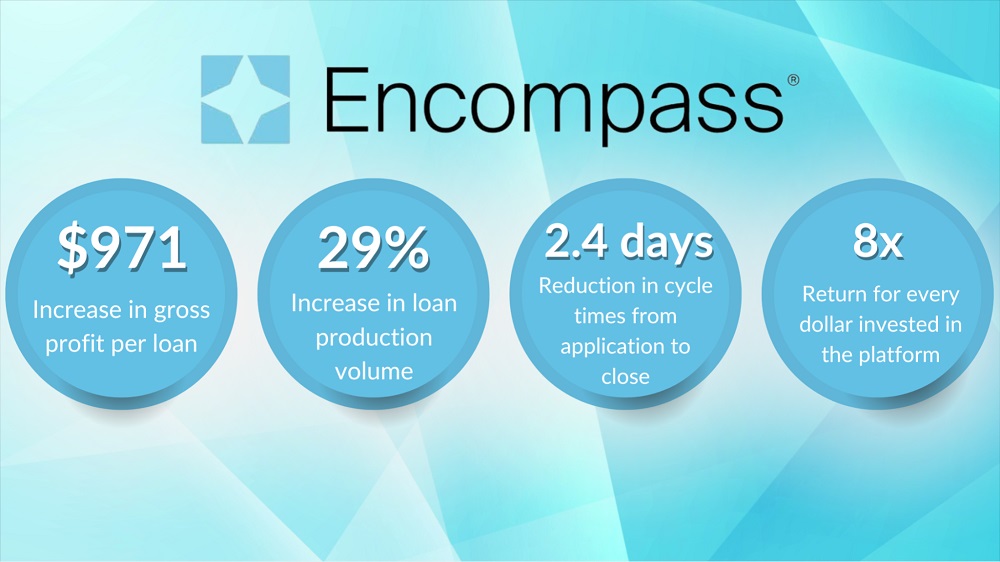

Encompass has cemented its place as an exceptional loan origination tool for credit unions, banks, and various mortgage/lending firms. It serves as a comprehensive mortgage management solution, streamlining the loan origination process, guiding advisors through evolving regulations, and simplifying intricate workflows. What does this mean for your company? Accelerated loan closures, heightened profitability, and fostering relationships with today’s customers into relationships that last a lifetime.

When you think about the key challenges facing those working within wealth management today, what comes to mind? There are the usual suspects: struggling with maintaining compliance, adapting to changing market conditions, and continuing to meet evolving customer expectations – all while differentiating themselves from a tight competition. But for many, it’s the loan origination process, which can easily become time-consuming and complicated. Encompass stands as a leading solution to many of these pain points with features designed to make empowered decisions, decrease expenses, remain compliant, and fuel innovation:

- Superior Loan Origination tools for creating, processing, and managing loan applications, helping to not only streamline the entire origination process, but ensure stellar customer experiences.

- Simplify Workflows with intelligent automation, reducing manual tasks and improving overall efficiency.

- Maintain Compliance thanks to Encompass’s tools for incorporating compliance checks and validations into processes.

- Manage Documentation with ease via seamless document collection, organization, and storage, ensuring that all necessary documents are readily accessible.

- Accelerate Sales by leveraging Encompass’s intelligent data and analytics capabilities. Gain a panoramic view of industry trends, the performance of teams, and easily identify opportunities to optimize business processes.

Encompass and Salesforce – How Integration Revolutionizes Loan Origination

Relying solely on loan origination tools can sometimes slow down lenders from working as efficiently as they could be. Why? Traditionally, lenders divide their time, spending half within Salesforce for borrower interactions and management, and the other half in a separate system for accessing loan details. However, by integrating Encompass and Salesforce, this friction dissolves, replaced instead by a single source of truth – something especially valuable for those working in the banking and lending industries. Together, Encompass and Salesforce boast a whole host of benefits for its users:

- Seamlessly Synchronize Data from both platforms to ensure that all departments consistently work with the most up-to-date information. For example, when a loan officer updates a loan file in Encompass, the changes are instantly reflected in Salesforce. This real-time data synchronization eliminates the potential for errors due to outdated information and improves operational efficiency.

- 360-degree Reporting empowers your team to make more informed decisions and drive meaningful growth. With a more comprehensive view of information, users can identify opportunities for upselling and cross-selling, predict market trends, and make strategic decisions to drive business growth.

- Enhance Customer Experiences by providing your sales team with a comprehensive view of each customer’s loan status. This information is instrumental in personalizing communication and delivering tailored services that surpass customer expectations.

- Maximize Productivity for loan officers with next-level automation capabilities. Quickly access customer data and loan status from Salesforce without platform-hopping, freeing up valuable time to instead invest in strategic activities.

- Strengthen Compliance thanks to Salesforce tracking all customer interactions, while Encompass manages all loan-related activities. Full visibility into critical business proves invaluable during audits, offering a detailed activity record that supports your compliance with diverse regulations.

Company Case Study

Let’s take a look at the case of Amy and Chris.

Challenges

Recently married couple, Amy and Chris, are eager to purchase their very first home. The couple reached out to a mortgage company that was well-known in their area. However, as they delved into the loan application process, they quickly discovered an intricate web of complexities that began to tarnish the journey to homeownership before it had truly even begun. Challenges included:

- Amy and Chris found themselves with a disjointed experience as communication happened across a number of channels, leading to confusion, frustration, and ultimately, critical delays.

- What seemed like a relatively straightforward process actually involved endless paperwork. Further, the now unhappy, happy couple needed to submit the same documents multiple times, resulting in frustration and wasted time.

- The inability to track the progress of their loan in real-time left Amy and Chris anxious and uninformed about their application status.

- Without an integrated system, the loan officers lacked instant access to relevant borrower information, making it difficult to provide more personalized assistance to Amy and Chris when questions arose.

- Many of the hurdles Amy and Chris faced not only seemed avoidable but also left them feeling frustrated and ignored as a client.

Solutions

Fed up with the relentless cycle of confusion and delays, Amy and Chris reached a breaking point. The pair made the decision to switch to a new company that leveraged an integration of Encompass and Salesforce. From the start, it was immediately evident that this company had invested in a seamless customer experience, allowing the couple to feel that their journey to homeownership was deeply valued. Here’s how this integration enabled them to provide Amy and Chris with a unified and personalized loan experience:

- Amy and Chris noticed an immediate change in their experience. All communication was centralized within Salesforce, allowing them to receive frequent updates and respond with ease.

- The couple traded seemingly endless paperwork for a more streamlined document submission process. With Encompass, documents were uploaded once, and data was automatically synced across the platform.

- By leveraging Encompass and Salesforce, Amy and Chris were empowered by real-time status updates on their loan application, alleviating stress and keeping them informed at all times.

- Loan officers at this new company used Encompass and Salesforce integration to access the couple’s complete borrower history, providing tailored guidance and assistance that left the pair feeling like their goals were wholly understood.

Results

Amy and Chris’s experience with their new financial institution showcased the transformative power of an Encompass and Salesforce integration. The integrated approach not only addressed their pain points but created a hyper-smooth and transparent journey:

- The loan application process was significantly faster compared to their previous experience.

- Real-time updates reduced stress and uncertainty, fostering a positive borrower-lender relationship.

- Personalized interactions and efficient document handling showcased the company’s commitment to customer satisfaction.

Why AGG?

When it comes to finding the right partner for technology integration and digital transformation, it’s crucial to find a company with the right experience. Access Global Group offers a unique position thanks to our combination of global deployment expertise and the nimbleness of a boutique firm. With over 15 years of diverse industry experience and a Salesforce Summit (Platinum) level partner status, Access Global Group ensures that your agency’s needs and expectations are met throughout the integration process. As an Encompass Consulting Partner, Access Global Group offers a premier integration of Salesforce and Encompass with a one-of-a-kind project methodology that places our clients at the forefront of every decision made. Our extensive experience working with Salesforce and the financial services industry further underscores our ability to provide the best possible solutions for your business.

Get the latest Salesforce news

Subscribe to get the latest Salesforce blogs, guides, industry reports, events, and all things Salesforce related!

FREE Salesforce Assessment!

To demonstrate confidence in our ability as Salesforce Partners, we’re offering you the a FREE Salesforce Organizational Assessment.

Let's Get Started on Your Salesforce Project!

Salesforce

PLATINUM

PARTNER

Salesforce

APPEXCHANGE

G2

USER REVIEWS