Top 5 Insurance Digital Priorities 2023

Jenna Trott

Jenna Trott

5 min read | MARCH 31, 2023

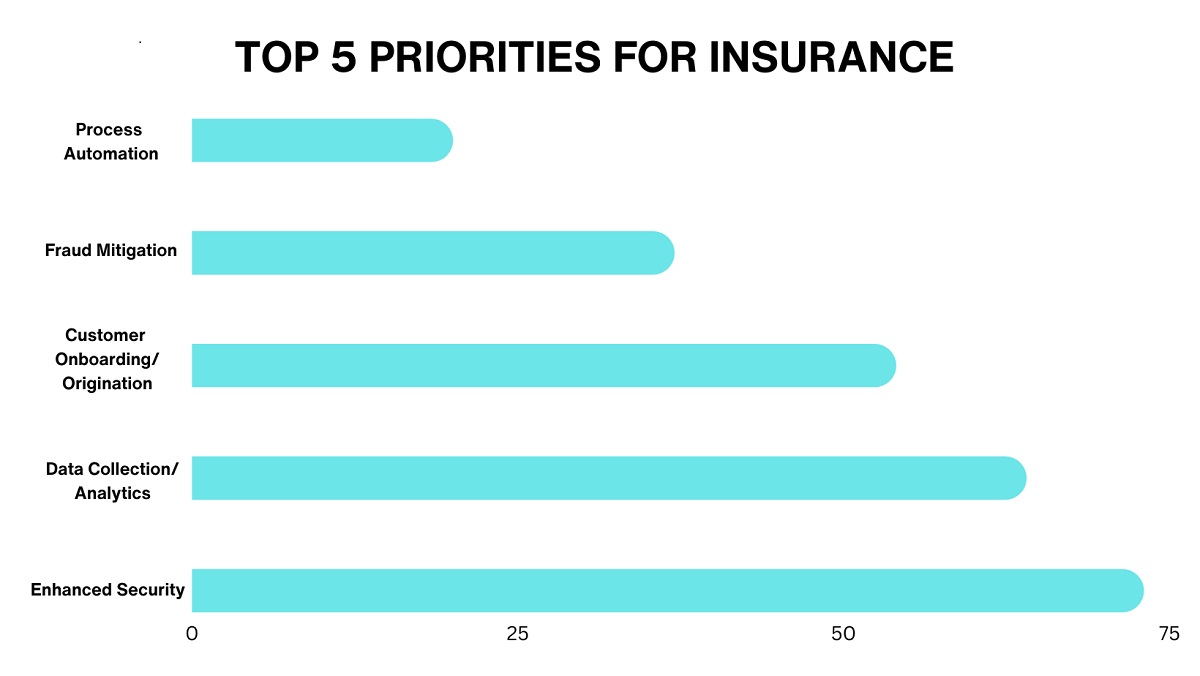

In a recently conducted survey by Arizent, 525 qualified respondents across financial services were asked about their organizations tech initiatives. As we move further into 2023, the following 5 aspects of tech are being prioritized by insurance, banking, mortgages and wealth management industries alike.

To view the full report, click here.

Why are these priorities important for insurance agencies?

If things like process automation, fraud mitigation, customer onboarding/origination, data collection/analytics and security aren’t already a priority for your insurance agency, here’s why they should be:

Security: Unsurprisingly, security tops the list of importance for insurance agencies as they regularly handle vast amounts of sensitive data, including personal and financial information. And as we continue to push toward a new digital frontier, safeguarding said data can be tricky. In today’s digital age, cybersecurity threats are becoming increasingly sophisticated, and insurance companies are becoming prime targets for cybercriminals. But just as insurers can utilize technology to maximize data intake, they can use it as a tool for protection as well. Securing customer data via methods like encryption and multi-factor authentication have become standard practice by many insurance agencies, but we can expect to see the adoption of advanced technologies like artificial intelligence. AI works to identify potential security threats and prevent them before they happen by analyzing vast amounts of data in real-time – enabling insurers to quickly detect and respond to potential cyber attacks. Insurance agencies can also leverage the power of the cloud to store and protect policyholder data. Cloud-based services offer advanced security features, such as data encryption, automatic backups, and real-time monitoring pre-installed, making them an attractive option for insurers looking to secure their customer’s information.

Data Collection & Analytics: With the explosion of digital technologies and the abundance of data generated by policyholders, insurers can leverage data collection and analytics to identify trends, detect patterns, and predict future outcomes. By collecting and analyzing data from various sources, like social media, claims history, and demographic information, insurance companies can create hyper-personalized products and services tailored to their customer’s specific needs. In the same way that AI and machine learning can supplement insurance agencies’ security initiatives, it can also be utilized to analyze vast amounts of data in real-time, identify patterns and anomalies, and make predictions based on historical data. Furthermore, insurers can leverage predictive analytics to forecast future events and trends, enabling them to proactively manage risks and improve business performance. Ultimately, this can help improve insurers’ relationship with policyholders by gaining insights into policyholders’ needs, preferences, and behaviors, take proactive steps to protect their policyholders against fraud risks and losses, and help communicate more effectively with their policyholders – providing them with the right information at the right time.

Customer Onboarding & Origination: Customer onboarding and origination processes can be tedious within the insurance industry due to a number of factors, including the need for extensive documentation, verification of identity and personal information, and adherence to regulatory compliance requirements (to name a few!). Both time-consuming and manual, these processes often lead to delays and frustration for both insurers and their customers, which is not the first impression agencies want to be giving. However, advanced technologies can help streamline the onboarding process, improving the customer experience and reducing the burden on insurers. These days, there are so many ways to simplify this process with the help of advanced technology. This includes leveraging chatbots and virtual assistants to help guide customers through each step of the process and collecting the necessary information in real-time. Further, advanced automation capabilities like data collection and verification can reduce the time and costs associated with the onboarding process, freeing up employees’ time to focus on more complex tasks. Utilizing digital forms and e-signatures can also reduce the need for manual data entry and paper-based forms, enabling a faster onboarding process.

Fraud Mitigation: Another unsurprising priority for insurance agencies is fraud mitigation as it can lead to substantial financial losses and reputational damage. Fortunately, there are many advanced technologies that are making it easier for insurers to detect and prevent fraudulent activity. Data analysis tools can quickly identify and isolate irregular patterns and anomalies that may suggest fraudulent claims. Similarly, streamlined claims processes makes it easier for insurers to detect and investigate suspicious activity quickly. Finally, certain cloud platforms offer robust security features and compliance tools to stop fraud at the source by helping insurers protect customer data and ensure regulatory compliance.

Process Automation: Last, but certainly not least, is process automation, which makes sense when considering all the ways that automation capabilities can address a number of the aforementioned digital priorities. Here are some key ways that automation can help insurance agencies:

- Reduce manual and repetitive tasks, improving overall operational efficiency.

- Streamline the claims process, making it faster and more accurate.

- Minimize errors and improve the accuracy of customer data.

- Enhance fraud detection and prevention capabilities.

- Improve customer experience by reducing wait times and simplifying the onboarding process.

- Provide real-time access to data and analytics, enabling better decision-making.

- Reduce costs associated with manual labor, paperwork, and other administrative tasks.

- Increase employee productivity, allowing staff to focus on more complex and high-value tasks.

- Enable better collaboration and communication across departments.

- Enhance overall operational agility, allowing insurers to adapt quickly to changing market conditions and customer needs.

Barriers to change

Although insurance agencies prioritize the above-mentioned concerns, implementing digital transformation to meet these objectives can be a challenge. When asked their top barriers to digital transformation, 78% of insurance CEOs say it was deciding on the right technology. This comes as no surprise as today’s digital era offers an overwhelming number of technological solutions to choose from. It can be daunting to decide which one is the right fit for your unique needs. However, one name that consistently rises to the top is Salesforce. As the world’s #1 CRM provider, Salesforce has been recognized as a leader in cloud technology solutions for companies of all industries and sizes. Their robust suite of products offers everything from customer relationship management to marketing automation and analytics tools. Here’s how Salesforce can not only help with insurer’s digital priorities but also build a sustainable roadmap for the future:

Security: Safeguarding sensitive data is of utmost importance for insurance agencies and Salesforce offers a secure cloud infrastructure that complies with global security standards such as GDPR, HIPAA, and SOC 2. Similarly, it offers features like data encryption, two-factor authentication, and IP restrictions, so unauthorized access to your data is prevented. Salesforce also provides monitoring tools that detect and respond to security threats in real-time. For added protection, insurance companies can use Salesforce Shield, a platform that provides advanced compliance and data protection features. By leveraging these comprehensive security capabilities, insurance companies can ensure that their data is safe and comply with regulatory requirements.

Data Collection & Analytics: Salesforce offers a suite of powerful tools and features that can not only help insurance agencies effectively collect and analyze data but also easily track key performance metrics with customizable dashboards and reports. Salesforce also offers an AI-powered analytics platform, CRM Analytics, which enables insurance agencies to make data-driven decisions by identifying trends, predicting outcomes, and optimizing business processes. Salesforce’s advanced data collection and analytics capabilities enables insurance agencies to gain a competitive edge by improving their customer engagement, increasing efficiency, and boosting their bottom line.

Customer Onboarding & Origination: Onboarding and origination are critical components of the insurance industry, and Salesforce provides a range of solutions that can help insurance agencies streamline these processes. With Salesforce’s customizable workflows and automated processes, agencies can efficiently onboard new clients while reducing the time and resources required for manual data entry and paperwork. In addition, Salesforce’s digital document management platform provides secure and efficient management of client documents, reducing the risk of document loss or errors and improving the accuracy and speed of the onboarding and origination process. Furthermore, Salesforce’s collaboration tools and integrations with other systems, such as e-signature solutions and third-party data sources, can further enhance the efficiency of these processes.

Fraud Mitigation: With Salesforce’s AI-powered fraud detection capabilities, insurance agencies can identify suspicious behavior and transactions in real-time, enabling them to take immediate action and prevent further losses. Salesforce also offers advanced analytics capabilities that enable agencies to analyze large volumes of data to identify patterns and trends associated with fraud. This can help agencies proactively identify potential fraud risks and take preventative measures. Additionally, Salesforce provides case management and investigation tools that enable agencies to manage fraud cases more efficiently and effectively. With these solutions, insurance agencies can not only improve their ability to detect and prevent fraud but also minimize the impact of fraudulent activity on their business and customers. This ultimately leads to greater customer trust, improved brand reputation, and increased profitability for the agency.

Process Automation: Process automation is an essential element for any insurance agency looking to improve efficiency and reduce costs – and luckily – Salesforce provides a range of solutions that can help! With Salesforce’s intuitive and customizable workflows, insurance agencies can automate tasks such as data entry, policy generation, and claims processing, which can save time, reduce errors, and improve overall productivity. Additionally, Salesforce’s automation capabilities can help agencies achieve greater consistency in their processes, ensuring that all tasks are completed to the same standard every time. Furthermore, Salesforce’s automation solutions can also enable insurance agencies to integrate with third-party systems, such as payment processors and document management platforms, streamlining processes and improving collaboration.

So, what are you waiting for?

Get started on the journey to digital transformation – TODAY

As insurance companies continue to invest in digital transformations, leveraging platforms like Salesforce will be crucial for companies to stay ahead and meet the evolving demands of their clients. With a wide range of features and benefits like seamless integration with other systems, customizable dashboards and reports, and automated workflows, Salesforce has become an indispensable tool among insurance agencies. Access Global Group’s team of certified experts know Salesforce inside and out. This means that when they come to you, no stone is left unturned and they’re able to solve any conflict with agility and accuracy. Regardless of where you are in the digital transformation journey, Access Global Group will provide customized solutions that align with your goals so you can focus on not only reaching them, but going far beyond what you thought was possible. Our unique project methodology of customer centricity allows us to provide intuitive solutions that are acutely catered to your organization’s needs. And as your premier Summit Salesforce Partners and Consulting Services/Managed Services experts with over 15 years in the industry, we’ll use our technical expertise to meet your unique needs and generate real change within your organization.

Don’t take our word for it – hear what our customers have to say on G2 and the Salesforce AppExchange!

Get the latest Salesforce news

Subscribe to get the latest Salesforce blogs, guides, industry reports, events, and all things Salesforce related!

FREE Salesforce Assessment!

To demonstrate confidence in our ability as Salesforce Partners, we’re offering you the a FREE Salesforce Organizational Assessment.

Let's Get Started on Your Salesforce Project!

Salesforce

PLATINUM

PARTNER

Salesforce

APPEXCHANGE

G2

USER REVIEWS