Bringing Trusted AI to Banks with Salesforce

Jenna Trott | JANUARY 16, 2024 | 5 Minute Read

The release of ChatGPT’s natural language processing capabilities to the general public has felt much like a tsunami. However, many companies have found it difficult to practically apply this untethered and unregulated energy into their industry in a way that is both trustworthy to customers and accurate. Salesforce steps in as a key player as they work to wrangle this innovation to bring something functional and truly transformative into our businesses.

There are undeniable benefits to employing natural language processing capabilities in the banking sector, like improving customer interactions, streamlining operations, and risk management – among others. However, as an industry that regularly handles sensitive information, prioritizing data security and customer trust is paramount. In this article, we’ll be looking at how Salesforce’s trusted AI is transforming banking without sacrificing clients’ vital information.

How Einstein AI is Transforming Banking

Einstein GPT, Salesforce’s latest AI technology, acts as a force multiplier for banks by augmenting human intelligence. It leverages natural language processing and machine learning algorithms to enhance customer experiences and enables banks to provide personalized and contextually relevant interactions across multiple channels, including chatbots and virtual assistants. The immediate impact for banks is nothing short of revolutionary, liberating agents from minute details and allowing them to invest more time, care, and attention in serving customers. With AI seamlessly providing scripted responses, the guesswork is eliminated, creating a streamlined and efficient agent experience.

For example, if a customer is planning a major life event like getting married, Einstein GPT can analyze their financial data and provide relevant advice on opening joint accounts, mortgages, and other financial products. It’s this level of personalization that fosters customer engagement, loyalty, and satisfaction. But this is just the beginning.

There are plans in place where AI navigates scripted interactions, seamlessly inserts policy information, and reconciles diverse policies. It’s a promising trajectory, where technology collaborates with human expertise not just to meet but exceed customer expectations, creating a dynamic and engaging future for the banking industry.

The Ethical Issues of AI

Ethical considerations should be at the forefront of AI implementation because while AI holds great promise, there are significant concerns and potential pitfalls that demand our collective attention. These include:

- Algorithmic Bias: AI systems may replicate biases present in training data, leading to unfair decision-making.

- Security Risks: Vulnerability to cyber attacks can disrupt operations and lead to financial losses.

- Privacy Violations: AI systems may process or store personal data without proper authorization.

- Lack of Transparency: There are difficulties in understanding how AI systems arrive at certain decisions, posing significant conflicts for audit trails.

- Automated Decision-Making Concerns: AI systems in finance automate things like trading, risk assessment, and loan approvals creating concerns about bias, inaccuracy, and potential discrimination.

- Unfair or Inconsistent Results: AI’s inability to understand human contexts and ethical considerations may result in unfair outcomes.

- Privacy Issues: AI-driven systems collecting vast amounts of personal data can lead to the possibility of data exposure to hackers or misuse for surveillance and marketing purposes.

- Ensuring transparency in AI algorithms by openly disclosing the data sources and decision-making processes.

- Companies must engage in the continuous monitoring and auditing of AI systems to identify and rectify biased outcomes

- Collaboration between technologists, ethicists, and regulatory bodies is vital to establish clear guidelines that prioritize fairness, inclusivity, and the avoidance of discriminatory practices.

Bringing Trusted AI to Banks with Salesforce

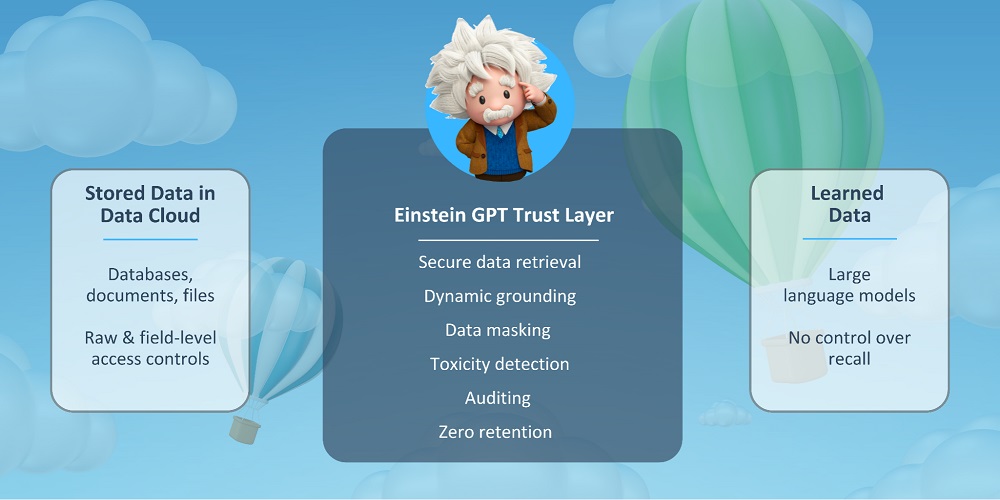

The introduction of Einstein GPT sparked a mix of enthusiasm but also hesitation regarding the ethical precautions that Salesforce would implement. Kathy Baxter, Principal Architect of the Ethical AI Practice at Salesforce, reiterated that trust stands as the foundation of every AI decision within the company. Kathy highlighted the crucial point that customer data is not treated as Salesforce’s product, emphasizing their dedication to privacy and security. As consumers, we’ve seen this manifest in what Salesforce calls the Einstein “Trust Layer,” which employs the following techniques to prioritize trust and transparency:

- Secure data retrieval

- Dynamic grounding

- Data masking

- Toxicity detectionAuditing

- 2Zero retention

When a customer reaches out to a service agent for assistance, Einstein securely retrieves relevant data, and “grounds” the prompt, meaning it is enriched with specific information tailored to the client while ensuring data masking obscures sensitive details. The outcome is a thoughtfully worded message, hyperpersonalized to the client’s personality, profession, and preferences.

Before reaching the recipient, the final message undergoes extensive testing to identify any toxicity or potentially unhelpful information, so that the content maintains the highest quality standards. The entire procedure follows a strict audit trail, ensuring accountability and transparency.

Finally, and perhaps most notably, Einstein GPT ensures zero retention of Personally Identifiable Information (PII) or Protected Personal Information (PPI), underscoring the commitment to handle all customer data responsibly, with the utmost privacy and ethical consideration.

Einstein GPT Use Cases

Leveraging Just AI

At their latest Dreamforce event, Salesforce offered a glimpse into the negative impact that relying solely on AI can have with an example:

Rachel needs to send a $100,000 wire to an investment bank but is facing issues in the process. She decides to connect with a service agent for more personalized assistance. The service agent, represented by a singular LLM (large language model), accepts the case and is equipped with tools to respond to Rachel’s request. However, the interaction hits a roadblock. The service agent responds, but it suggests fixing a non-existent problem and encourages the user that the company will figure out how to send the wire quickly, which ultimately is a task that cannot be accomplished.

In highly regulated industries like banking, AI models require industry fine-tuning, and firm-specific grounding to ensure accurate and reliable AI responses aligned with specific organizational policies and procedures.

Industry Fine-Tuned AI

Let’s re-examine the case of Rachel but instead of using a general AI, the service agent is using an AI model that’s been fine-tuned for the banking industry. The key difference in this situation is that this AI model has access to the necessary wire instructions, revealing that this investment bank is on the sanctions list and is not allowed to receive wire transfers. A significant issue could have arisen without access to this information but was averted thanks to multiple LLMs running concurrently. Ultimately, Rachel is happy with the outcome, and the focus extends beyond her situation. The interaction is closed, and a summary is automatically generated, creating a knowledge article to prevent other agents from making this same mistake.

As AI continues to evolve, its role in banking will become even more prominent. Salesforce’s commitment to developing trusted AI solutions positions it as a key player in shaping the future of banking. By leveraging Salesforce’s AI tools, banks can enhance productivity, deliver exceptional customer experiences, and build trust with their customers.

Why AGG?

When it comes to selecting the right partner for technology integration and digital transformation, the experience of the company you choose is of utmost importance. Access Global Group is a Salesforce Summit (Platinum) level partner with nearly two decades of experience in Salesforce integration, support, maintenance, and management services. Our team of certified experts knows Salesforce inside and out, meaning that when they come to you, no stone is left unturned and any conflicts are quickly addressed with agility and accuracy. With 5-star ratings on the Salesforce AppExchange and G2, our team offers a unique blend of global deployment expertise coupled with the agility of a boutique firm and a one-of-a-kind project methodology that places our clients at the forefront of every decision. Your successes are our successes, so we’re dedicated to providing solutions that align with your evolving requirements and aspirations.

The quality of your AI responses is only as good as the data behind it! We invite you to reach out to us with any questions or concerns regarding your Salesforce instance, we’d be happy to discuss a solution that best fits your needs at this time.

From proposals to quotes, contracts and more, Access Docs allows users to create and send consistent and accurate documentation to clients in a few simple clicks.

A seamless connection between Salesforce and QuickBooks. With automation of key processes, this application works to eliminate manual and duplicative efforts to empower your team.

A seamless connection between Salesforce and QuickBooks. With automation of key processes, this application works to eliminate manual and duplicative efforts to empower your team.

Get the latest Salesforce news

Subscribe to get the latest Salesforce blogs, guides, industry reports, events, and all things Salesforce related!

Let's Get Started on Your Salesforce Project!

Salesforce Innovations Transforming Insurance and Underwriting

At Access Global Group, we are committed to sustainability in every aspect of our operations. As a global leader in technology, specializing in remote work-from-home solutions…

Access Global Group Strategic Partnership With PeerIslands

At Access Global Group, we are committed to sustainability in every aspect of our operations. As a global leader in technology, specializing in remote work-from-home solutions…

Access Global Group Sustainability Annual Report

At Access Global Group, we are committed to sustainability in every aspect of our operations. As a global leader in technology, specializing in remote work-from-home solutions…

Digital Transformation Powered by Dedication & Expertise! Chat With Our Experts Today!