Salesforce AI: Redefining the Future of Insurance

Jenna Trott, Mignon Brooks | JANUARY 13, 2024 | 5 Minute Read

The Current Landscape of Insurance, Salesforce AI

Traditional practices have long anchored the insurance sector, often involving tedious paperwork, protracted underwriting procedures, and outdated, inflexible systems. However, the year 2023 saw a notable shift in priorities, with cloud and digital infrastructure becoming the top focus for 43% of insurance companies, according to an Arizent study.

Specifically, generative AI’s role within the global insurance market is growing, with its valuation exceeding 462.1 million USD in 2022, as reported by Precedence Research. Projections suggest a dramatic increase to nearly 8.1 million USD by 2032.

With the presence of generative AI accelerating, Salesforce tosses its hat into the ring with its Einstein platform, offering a transformative solution for the insurance sector. Einstein GPT is recognized as the world’s first Generative AI designed for Customer Relationship Management (CRM). It does this by utilizing advanced AI to streamline operations, improve customer relations, and enhance decision-making through predictive analytics.

Understanding these developments is crucial for those in the insurance industry. It not only provides insights into the future trajectory of the sector but also equips them with the knowledge to leverage this technology effectively. By staying informed, insurance professionals can strategically align their operations with these advancements, ensuring they remain competitive and relevant in a rapidly evolving landscape.

How Salesforce AI is Revolutionizing Insurance

Embarking through the maze of AI options can seem like a daunting task for insurers. It’s easy to feel swamped and uncertain about the first step. But here’s where Salesforce’s AI emerges, like a beacon in the fog. With its extraordinary instinctiveness, it doesn’t just solve age-old hurdles that insurers grapple with. It’s also paving the way for a ground-breaking transformation in the industry.

Specifically within property and casualty risk management, the capabilities of Salesforce AI’s predictive analytics truly stand out. A thorough examination of historical data and spotting patterns provides invaluable assistance to insurers. It helps forecast potential risks, leading to more precise pricing and better risk management. This involves estimating the chances of events such as natural disasters or accidents based on specific variables and identifying trends in claim history. Salesforce AI suggests preventative measures to decrease exposure to high-risk areas. This could involve guiding customers towards reducing their risk or tweaking their policy portfolio for a more balanced distribution of risk.

In customer service, Salesforce AI elevates exchanges via smart chatbots and virtual assistants, providing round-the-clock assistance. These tools can manage several customer interactions at the same time, lessening the burden on human customer service representatives and freeing them up to concentrate on more intricate tasks.

Workflow management is another field where Salesforce AI excels, automating tasks such as data registration, alerts, and policy renewal monitoring, enabling teams to work on more intricate responsibilities. AI guides users through procedures, decreasing inaccuracies and guaranteeing adherence to regulations while preserving an audit trail for performance monitoring, enhancement detection, and responsibility.

Finally, Salesforce AI revolutionizes approaches in marketing and sales through sophisticated CRM analytics. It explains customer behaviors and preferences for tailored campaigns and distinguishes promising leads and opportunities through its forecasting abilities. This allows insurers to concentrate on leads with substantial potential, enhancing the productivity of the sales team and amplifying performance. Moreover, Salesforce AI can suggest policy pricing to optimize earnings while maintaining competitiveness.

Challenges and Considerations

While it’s easy to marvel at the impressive benefits of AI, it cannot be forgotten that it’s a world where roses come with thorns. Yes, even in this sophisticated landscape of artificial intelligence, the unsuspected specter of bias can creep into our algorithms!

AI biases, a product of the data used to train AI models, can lead to unjust outcomes when applied, presenting significant challenges in the management and regular evaluation of data. To tackle these issues, Salesforce AI adopts stringent fairness measures and transparency protocols, which include frequent audits of AI algorithms to identify and reduce biases. It also ensures comprehensive representation by utilizing diverse data sets for training, thereby reducing the risk of bias.

For insurers, data governance is not just crucial but indispensable. It establishes guidelines, policies, and processes that ensure the appropriate data management throughout all stages, from collection and storage to processing and access. The use of Salesforce’s Responsible AI Toolkit is vital in establishing a customized AI governance framework, enhancing the value of data management in mitigating various risks in the insurance sector. Ensuring accurate and timely data minimizes risk to policyholders through better risk assessment and pricing. It reduces regulatory risk by guaranteeing compliance with data-related guidelines, enabling informed strategic decision-making and innovation.

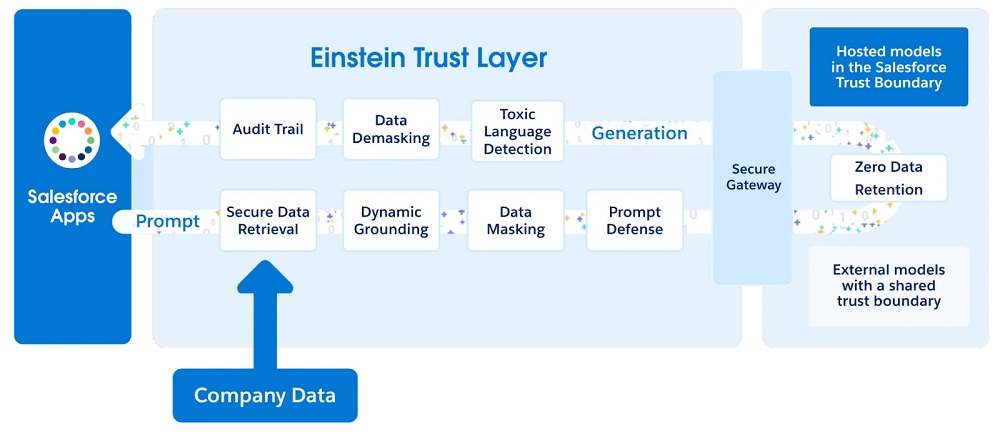

Adding another layer of protection is the Salesforce Einstein Trust Layer, a secure AI architecture that bolsters the security of generative AI. This system incorporates data and privacy safeguards into the user interface, offering dynamic data anchoring with up-to-the-minute information, thus guaranteeing secure and dependable data handling in AI systems.

So, what are the implications for insurers? Salesforce AI provides a working environment that’s transformative. Through robust data management and governance provided by Salesforce AI, insurers can minimize risks and make informed strategic decisions by integrating fairness measures, transparency protocols, and the secure Einstein Trust Layer. To access the power of generative AI, starting with Salesforce is essential. However, to ensure that the AI operates optimally and avoids data hallucinations, optimizing your Salesforce instance is crucial, ensuring it utilizes only the best available data. Whether your goal is to streamline insurance processes or to innovate your data management, Access Global Group is ready to assist you. Reach out to us today to discuss how we can help you harness the full potential of AI in your operations.

Why AGG?

When it comes to selecting the right partner for technology integration and digital transformation, the experience of the company you choose is of utmost importance. Access Global Group is a Salesforce Summit (Platinum) level partner with nearly two decades of experience in Salesforce integration, support, maintenance, and management services. Our team of certified experts knows Salesforce inside and out, meaning that when they come to you, no stone is left unturned and any conflicts are quickly addressed with agility and accuracy. With 5-star ratings on the Salesforce AppExchange and G2, our team offers a unique blend of global deployment expertise coupled with the agility of a boutique firm and a one-of-a-kind project methodology that places our clients at the forefront of every decision. Your successes are our successes, so we’re dedicated to providing solutions that align with your evolving requirements and aspirations.

We invite you to reach out to us with any questions or concerns regarding your Salesforce instance, we’d be happy to discuss a solution that best fits your needs at this time.

From proposals to quotes, contracts and more, Access Docs allows users to create and send consistent and accurate documentation to clients in a few simple clicks.

A seamless connection between Salesforce and QuickBooks. With automation of key processes, this application works to eliminate manual and duplicative efforts to empower your team.

A seamless connection between Salesforce and QuickBooks. With automation of key processes, this application works to eliminate manual and duplicative efforts to empower your team.

Get the latest Salesforce news

Subscribe to get the latest Salesforce blogs, guides, industry reports, events, and all things Salesforce related!

Let's Get Started on Your Salesforce Project!

Salesforce Innovations Transforming Insurance and Underwriting

At Access Global Group, we are committed to sustainability in every aspect of our operations. As a global leader in technology, specializing in remote work-from-home solutions…

Access Global Group Strategic Partnership With PeerIslands

At Access Global Group, we are committed to sustainability in every aspect of our operations. As a global leader in technology, specializing in remote work-from-home solutions…

Access Global Group Sustainability Annual Report

At Access Global Group, we are committed to sustainability in every aspect of our operations. As a global leader in technology, specializing in remote work-from-home solutions…

Digital Transformation Powered by Dedication & Expertise! Chat With Our Experts Today!