Financial Forecast: Data Cloud Potential within The Financial Services Industry

Jenna Trott | FEBRUARY 13, 2024 | 5 Minute Read

Yet, amidst this uncertainty, one thing remains clear: data serves as the cornerstone. From the boardrooms where crucial decisions are made to the frontlines where customer interactions unfold – where data leads, innovation follows. In this article, we’ll delve into the many ways Salesforce Data Cloud can empower businesses across various industries, specifically the financial services industry, from unlocking valuable insights to fostering meaningful customer relationships and beyond.

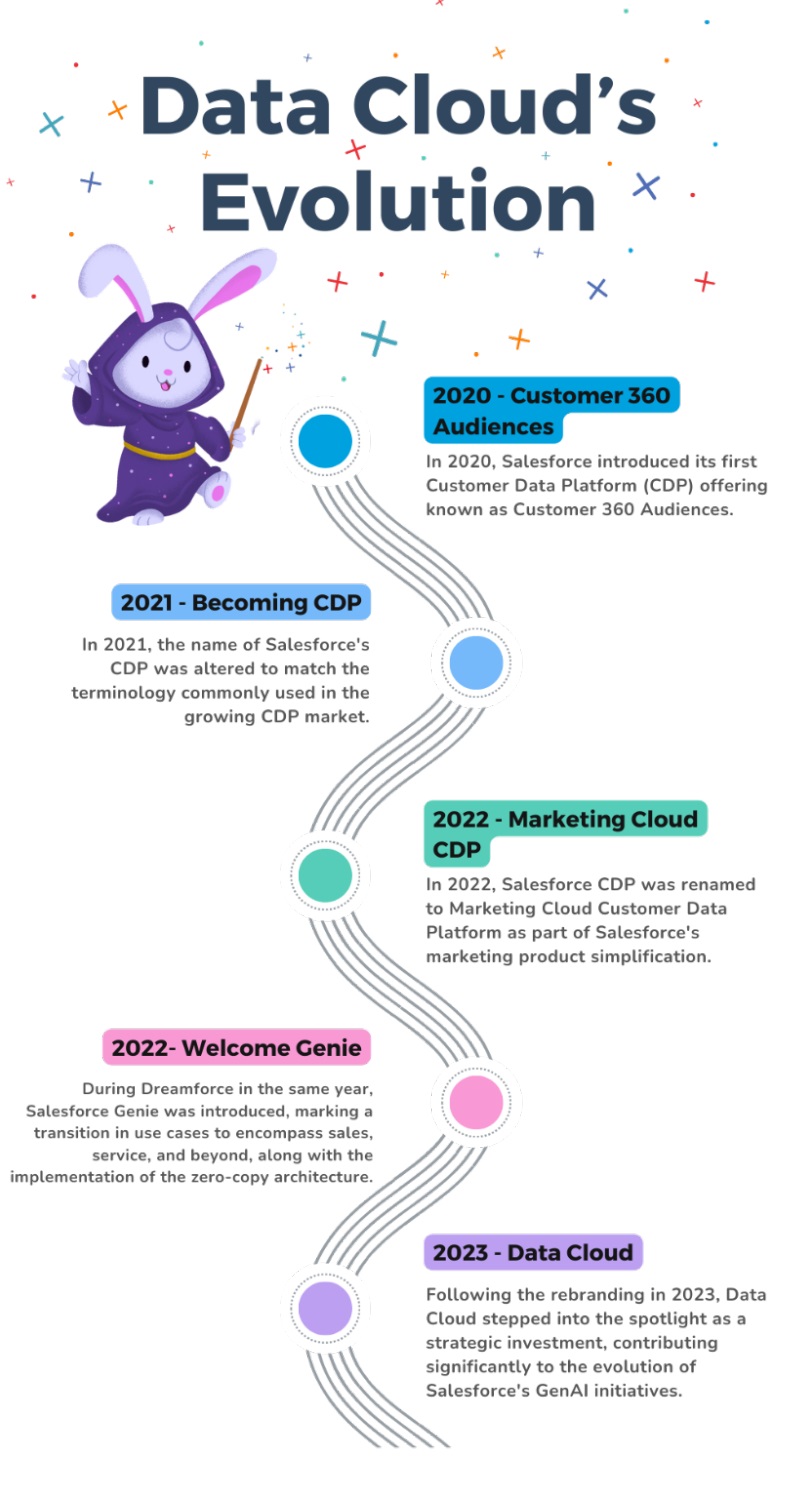

The History of Salesforce Data Cloud

Data Cloud has evolved significantly since its inception, with Salesforce continuously enhancing its capabilities to meet the growing demands of businesses. Originally known as Customer 360 Audiences, Salesforce’s first Customer Data Platform (CDP), has undergone several name changes to reflect its development and expanded functionalities. The current iteration of Data Cloud represents a powerful, AI-powered platform that enables organizations to connect and leverage their data across the Salesforce ecosystem.

Okay…but what exactly is Data Cloud?

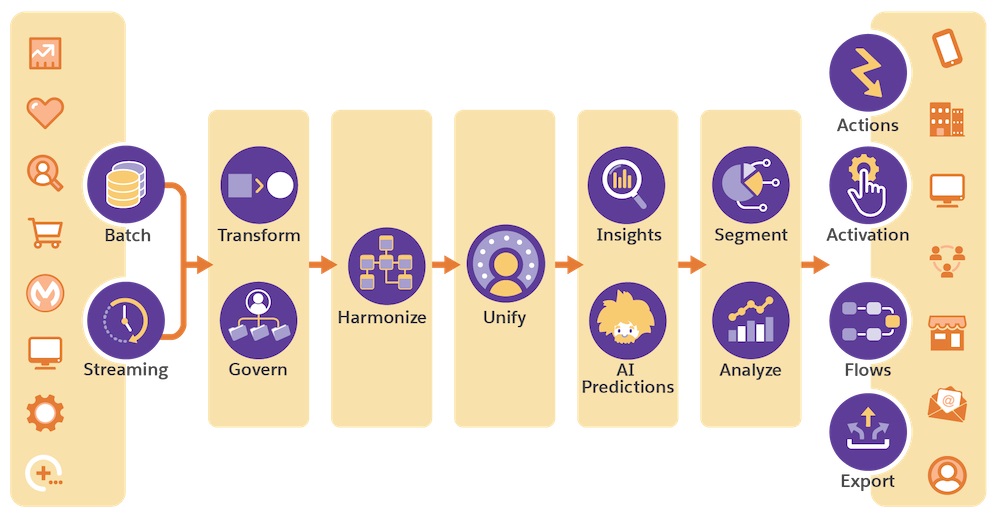

Salesforce Data Cloud is a comprehensive data platform that empowers businesses to unlock the full potential of their data. By leveraging advanced technologies like AI and machine learning, Data Cloud automates data mapping and provides intelligent recommendations for data harmonization. It does this by aggregating a vast array of high-quality data from multiple reputable sources, including business directories, social media platforms, and third-party providers. This data is then enriched with additional attributes such as firmographic details, contact information, and demographic insights, providing businesses with a comprehensive view of their target audience and market segments.

Image from Salesforce.com

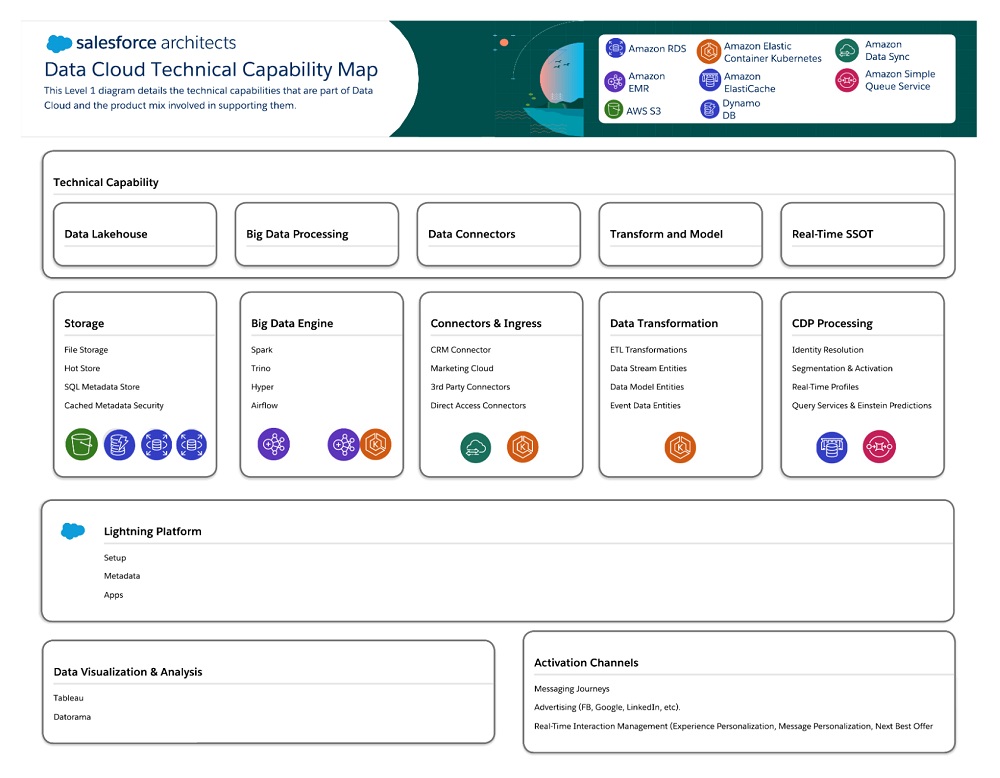

Data Cloud Technical Capabilities

Salesforce Data Cloud is not your typical CDP, it offers a comprehensive set of technical capabilities to handle and process data efficiently. At its core is the data lake house, a sophisticated storage solution unlike any traditional database you’ve encountered. Here, data is stored in a parquet file format within S3 buckets, with DynamoDB ensuring lightning-fast access to a subset of this information. From customer data profiles to metadata security, every aspect is meticulously stored and managed, seamlessly integrating with Salesforce via Amazon Relational Database Service (RDS).

On top of this storage infrastructure, Spark, Presto, and Trino work in harmony to ingest and process petabyte-scale data, orchestrated by Airflow for seamless operation. Leveraging Amazon EMR and Amazon EMR on Elastic Kubernetes Service (EKS), Salesforce ensures flexibility and efficiency in processing data.

Data transformation is key to aligning diverse data sources with Salesforce’s structure, and the Data Cloud UI makes this process a breeze. Once data is mapped to S objects, it becomes the single source of truth, enabling real-time actions like identity resolution, profile matching, and segmentation. With the power of SQL, AI, and automation through activation channels, businesses gain valuable insights and create personalized experiences at scale.

And here’s the magic—all of this is made possible by the Lightning Platform, seamlessly integrating metadata definitions and enforcement, alongside powerful visualization and analysis tools like Tableau within Customer 360.

In essence, the Data Cloud is not just another data lake—it’s a game-changer, empowering businesses to understand their customers better and create meaningful connections at scale.

Image from Salesforce.com

Leveraging Data Cloud in the Financial Services Industry

The financial services industry is data-intensive, relying on vast amounts of information to make critical business decisions, gain a comprehensive view of customers, manage risk, and comply with regulatory requirements. However, the complex nature of financial data, coupled with the presence of legacy systems and siloed data sources, makes the integration of data from multiple sources a daunting task.

Data Cloud addresses these challenges by providing a unified platform for data integration and harmonization, enabling financial institutions to unlock valuable insights and drive growth. It accomplishes this in a number of ways.

Unified Customer Profiles: The Key to Personalization

Creating a 360-Degree View of Customers

Creating a 360-degree view of customers creates a holistic understanding of their preferences, behaviors, and interactions with a business. Data Cloud enables financial institutions to create unified customer profiles by consolidating data from various sources, such as transactional systems, CRM platforms, and external data providers. These profiles provide a comprehensive view of each customer, allowing organizations to deliver personalized experiences and targeted marketing campaigns.

Leveraging Data Cloud for Personalized Interactions

Personalization is a powerful tool for financial institutions to engage customers and build loyalty. With Data Cloud, organizations can leverage customer profiles to tailor interactions across channels, delivering relevant and personalized experiences. For example, a bank can use customer data to offer personalized product recommendations, targeted offers, and proactive support, enhancing the overall customer experience.

Real-time Insights for Proactive Decision-making

Data Cloud provides real-time data and insights, enabling financial institutions to make proactive decisions and respond to customer needs as soon as they arise. By leveraging AI and machine learning capabilities, organizations can analyze customer data in real-time, identify trends, and anticipate customer behavior. These insights empower financial institutions to offer dynamic solutions, address customer concerns, and seize opportunities in a rapidly changing market.

Data Harmonization and Identity Resolution

Data Cloud’s Role in Identity Resolution

Identity resolution is the process of linking customer data from different sources to create a unified customer profile. In the financial services industry, where organizations interact with customers across multiple touchpoints, identity resolution ensures a seamless and personalized customer experience. Data Cloud leverages sophisticated algorithms and AI-powered matching capabilities to resolve identities, enabling financial institutions to create accurate and complete customer profiles.

Streamlining Operations with Harmonized Data

Harmonized data not only improves decision-making but also streamlines various operations within financial institutions. With Data Cloud, organizations can automate data workflows, ensure data quality and consistency, and enable seamless data sharing across departments. This streamlining of operations enhances operational efficiency, reduces manual errors, and enables financial institutions to focus on strategic initiatives.

Data Privacy and Security in the Financial Services Industry

Ensuring Compliance with Regulatory Requirements

The financial services industry is highly regulated, with strict requirements regarding data privacy and security. Financial institutions must adhere to various regulations like General Data Protection Regulation (GDPR) to protect customer data and ensure compliance. Data Cloud prioritizes data privacy and security, offering robust measures to safeguard sensitive information and helping financial institutions meet regulatory requirements.

Data Security Measures in Data Cloud

Data security is a top priority for financial institutions, given the sensitive nature of customer information. Salesforce’s Data Cloud employs industry-leading security measures to protect data at rest and in transit. These measures include encryption, access controls, and regular security audits. With Data Cloud, financial institutions can rest easy knowing that their data is safe, minimizing the risk of breaches and preserving the sanctity of customer confidentiality. Because when it comes to data security, there’s no room for compromise.

Data Cloud’s Commitment to Data Ethics

At their core, Salesforce believes that data ethics isn’t just a nice-to-have, it’s a fundamental pillar of responsible data management. By prioritizing the ethical use of data, financial institutions can form stronger bonds of trust with their customers while safeguarding their esteemed reputations. Through robust consent management protocols, automated policy enforcement, and a steadfast commitment to responsible data utilization, Data Cloud empowers financial institutions to navigate the complex landscape of data governance with confidence.

Accelerating Digital Transformation with Data Cloud

Driving Innovation and Agility in Financial Services

Digital transformation is a key priority for financial institutions seeking to stay competitive in today’s rapidly evolving landscape and Data Cloud can make it happen. By enabling organizations to harness the power of data and drive innovation, accelerating digital transformation has never been easier. With Data Cloud, financial institutions can break down data silos, leverage AI and automation, and foster a culture of data-driven decision-making, empowering them to adapt to changing customer expectations and market dynamics.

Enabling Seamless Integration with Existing Systems

Data integration lies at the heart of digital transformation, but this can become complicated as financial institutions need to connect and leverage data from various systems and sources. Data Cloud simplifies the integration process by offering pre-built connectors and tools that streamline data integration efforts. This means that financial institutions can seamlessly integrate Data Cloud with their existing infrastructure, ensuring a smooth transition and maximizing the value of their data.

Leveraging AI and Automation for Enhanced Efficiency

Salesforce’s move towards an AI-powered CRM marks a significant shift in the way customer relationship management is approached. By integrating artificial intelligence (AI) capabilities into its CRM platform, Salesforce aims to enhance the functionality and effectiveness of its solutions. This integration underscores the growing importance of leveraging AI alongside data within CRM systems to unlock valuable insights, improve decision-making processes, and deliver personalized customer experiences. By harnessing AI-driven algorithms, Salesforce empowers businesses to analyze vast amounts of data more efficiently, identify patterns and trends, automate repetitive tasks, and ultimately, drive better outcomes across the entire customer lifecycle. This strategic emphasis on AI-powered CRM reflects Salesforce’s commitment to innovation and its recognition of the transformative potential of AI in shaping the future of customer engagement and relationship management.

Salesforce Data Cloud stands as a powerful solution for financial institutions seeking to harness the power of data to drive growth, enhance customer experiences, and stay ahead of the competition. By integrating and harmonizing data from various sources, Data Cloud enables organizations to gain valuable insights, foster meaningful customer relationships, and make data-driven decisions. As the financial services industry becomes increasingly data-intensive, Data Cloud empowers institutions to unlock the full potential of their data and fuel their digital transformation journey.

Looking to get started? We can help!

Why AGG?

When it comes to selecting the right partner for technology integration and digital transformation, the experience of the company you choose is of utmost importance. Access Global Group is a Salesforce Summit (Platinum) level partner with nearly two decades of experience in Salesforce support, maintenance, and management services. Our team of certified experts knows Salesforce inside and out, meaning that when they come to you, no stone is left unturned and any conflicts are quickly addressed with agility and accuracy. With 5-star ratings on the Salesforce AppExchange and G2, our team offers a unique blend of global deployment expertise coupled with the agility of a boutique firm and a one-of-a-kind project methodology that places our clients at the forefront of every decision. Your successes are our successes, so we’re dedicated to providing solutions that align with your evolving requirements and aspirations.

We invite you to reach out to us with any questions or concerns regarding your Salesforce instance, we’d be happy to discuss a solution that best fits your needs at this time.

From proposals to quotes, contracts and more, Access Docs allows users to create and send consistent and accurate documentation to clients in a few simple clicks.

A seamless connection between Salesforce and QuickBooks. With automation of key processes, this application works to eliminate manual and duplicative efforts to empower your team.

A seamless connection between Salesforce and QuickBooks. With automation of key processes, this application works to eliminate manual and duplicative efforts to empower your team.

Get the latest Salesforce news

Subscribe to get the latest Salesforce blogs, guides, industry reports, events, and all things Salesforce related!

Let's Get Started on Your Salesforce Project!

Salesforce Innovations Transforming Insurance and Underwriting

At Access Global Group, we are committed to sustainability in every aspect of our operations. As a global leader in technology, specializing in remote work-from-home solutions…

Access Global Group Strategic Partnership With PeerIslands

At Access Global Group, we are committed to sustainability in every aspect of our operations. As a global leader in technology, specializing in remote work-from-home solutions…

Access Global Group Sustainability Annual Report

At Access Global Group, we are committed to sustainability in every aspect of our operations. As a global leader in technology, specializing in remote work-from-home solutions…

Digital Transformation Powered by Dedication & Expertise! Chat With Our Experts Today!