How AI is Reshaping the Insurance Industry

Jenna Trott | FEBRUARY 14, 2024 | 5 Minute Read

AI is seemingly everywhere, and while insurance companies are starting to embrace it, the adoption rate remains relatively low. According to a Deloitte study, while 32% of software and internet technology companies have begun investing in AI, only 1.33% of insurance companies have followed suit. This hesitation may stem from challenges related to integration or perhaps a reluctance to adopt new technologies in an industry that’s highly regulated. In this article, we will explore the implementation challenges faced by insurers as well as highlight how AI is reshaping the insurance industry.

Benefits of Implementing AI in the Insurance Industry

The insurance industry, long characterized by its reliance on traditional processes, is undergoing a profound transformation with the integration of artificial intelligence technologies. And ultimately, the key question is not whether insurance companies are using AI, but rather how effectively and strategically they are leveraging it. It’s important to note that AI will not have the same impact across the insurance value chain. Significant areas of impact include:

Streamlined Business Processes

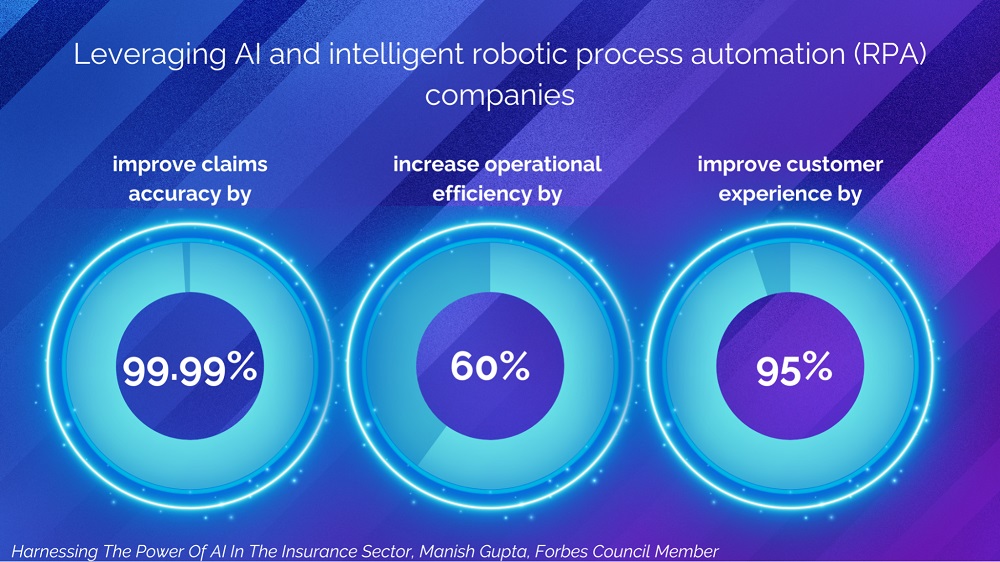

AI streamlines business for insurance agencies by leveraging techniques like supervised learning to enhance processes. By automating repetitive tasks and analyzing vast datasets, AI enables insurance agencies to allocate resources more effectively, improve operational efficiency, and deliver better customer experiences.

Underwriting Benefits

AI-driven underwriting revolutionizes insurance by leveraging vast digital data, aiding underwriters in swift document identification and data extraction. This streamlines processes, leading to increased sales, improved customer experiences, and enhanced loss ratios through precise risk classifications and data-driven decisions.

Policy Benefits

AI enhances policy review processes by augmenting human capacity through natural language understanding, enabling the analysis of policies, extraction of critical information, and highlighting misalignments. By comparing documents, AI accelerates and enhances policy review processes, contributing to increased efficiency and accuracy in insurance agencies.

Risk Engineering

AI plays a pivotal role in transforming risk engineering for insurance agencies by addressing challenges arising from the proliferation of third-party risk providers. It aids in evaluating specialized research reports and mitigating the shortage of risk engineers, contributing to more effective risk assessment. Additionally, AI enables insurers and reinsurers to utilize diverse data sources, including telematics, remote sensors, satellite images, and digital wellness records, further enhancing risk assessment and improving understanding of customers.

Elimination of Routine Tasks

With 50% of the insurance workforce expected to retire in the coming years, there’s a pressing need for large-scale automation to fill the ensuing talent gap. Generative AI facilitates the creation of AI chatbots and virtual assistants, enabling them to handle routine tasks like providing policy information and changing coverage, thus freeing up human agents to focus on more complex sales, claims, and billing situations. This shift towards digital interactions aligns with consumer preferences for streamlined processes, as evidenced by mobile claims submissions rising by 77% from 2018 to 2021.

Claims Benefits

A recent survey found that 68% of all insurance policyholder complaints were related to claims.

AI enhances back-end processes and enables innovative insurance solutions, while also streamlining claims processing by speeding up the process, increasing accuracy, and organizing claim components for a comprehensive view. Additionally, generative AI automates claims processing by analyzing historical claims and identifying patterns, improving efficiency and accuracy.

These advancements are crucial, as studies show that 87% of customers consider claims processing effectiveness when renewing their insurance with the same insurer.

Challenges of Implementing AI in the Insurance Industry

Within the insurance industry, there are many regulations in place, meaning that implementing AI is not without its fair share of challenges:

Complex Technology

Boasting billions or trillions of parameters, Generative AI models pose significant technical challenges due to practicality and high costs.

Presence of Legacy Systems

Integrating generative AI into current technology setups presents a herculean challenge as IT leaders navigate the dilemma of executing a seamless integration of new systems with legacy infrastructure or opting for a complete overhaul.

Increased Risk of Technical Debt

The cost associated with acquiring and maintaining the necessary computational resources for training and deploying generative AI models can not only be a cause of reluctance for many organizations but can also lead to technical debt. Failure to correctly implement can disrupt the entire system.

Data Requirements

Generative AI models typically require vast amounts of high-quality training data, which may be challenging to obtain or curate, especially for niche or specialized domains.

Interpretability and Explainability

Understanding and interpreting the outputs generated by generative AI models can be challenging due to their complexity, potentially hindering trust and adoption in critical applications.

Scalability

Scaling generative AI models to handle large volumes of data or increasing computational demands while maintaining performance and efficiency is a highly complex task.

Regulatory Compliance

Ensuring compliance with data protection regulations and ethical considerations when dealing with sensitive or personal data used to train generative AI models poses additional technical challenges.

How Insurers Can Mitigate AI Implementation Challenges

Integrating AI into insurance operations presents both opportunities and challenges. To mitigate risks and ensure successful implementation, insurers can adopt several key strategies:

Develop a clear understanding of AI

It’s essential for insurance companies to educate themselves about the capabilities and limitations of AI technologies relevant to their business objectives.

Identify use cases

Insurers should identify specific areas within their operations where AI can add value and address existing challenges effectively.

Develop a data strategy

A robust data strategy is crucial for AI implementation, ensuring that insurers have access to high-quality data for training and validating AI models.

Build an AI team with a clear roadmap

Establishing a dedicated team with expertise in AI and a clear roadmap for implementation can help ensure smooth integration and effective utilization of AI technologies.

Invest in infrastructure

Adequate investment in infrastructure, including hardware, software, and IT systems, is essential to support AI implementation and ensure scalability and reliability.

Consider partnerships

Collaborating with external partners, such as AI technology providers or consulting firms, can provide additional expertise and resources to develop and execute AI integration plans effectively. Working closely with these partners can help insurers navigate the complexities of AI implementation and maximize the benefits of AI technologies in their operations.

Getting Started

Undoubtedly, AI holds tremendous transformative potential for the insurance industry. Yet, its efficacy hinges heavily on the quality of data used to train the systems. Insurers must address the limitations of their legacy core systems, which were not originally equipped for today’s data-intensive landscape. These systems, built on closed technologies and monolithic architectures, require modernization to enable effective pattern detection and intelligent AI outputs. Salesforce consulting partners bring a wealth of expertise and experience to help insurers navigate the complexities of AI integration, data clean-up efforts, and system overhauls effectively, ultimately driving innovation and efficiency in their operations, here’s how:

AI Integration Expertise

Salesforce partners offer specialized knowledge in AI integration with Salesforce systems. They evaluate existing workflows to pinpoint AI opportunities and develop tailored solutions to meet insurer’s needs.

Data Strategy Support

Salesforce consultants assist insurers in crafting robust data strategies, including cleaning, normalization, and enrichment. They address data quality issues to ensure accuracy for AI model training and analysis.

System Overhaul Guidance

Consultants guide insurers in overhauling systems to align with AI integration goals. This involves redesigning workflows, optimizing architecture, and implementing features for effective AI-driven processes.

Custom Development

Salesforce partners specialize in custom development and integration with third-party AI tools. They create customized AI solutions or seamlessly integrate existing technologies into the insurer’s Salesforce environment.

Change Management

Consultants provide change management support, including stakeholder engagement and user training, to facilitate a smooth adoption of AI-driven processes across the organization.

Generative AI is transforming the insurance industry, offering insurers new opportunities to enhance customer experience, automate routine tasks, and make more accurate risk assessments. While challenges exist in implementing generative AI, organizations can overcome them by leveraging digital adoption platforms, integrating legacy systems, addressing technical debt, and ensuring the responsible use of AI technologies. By embracing generative AI and leveraging solutions like Salesforce’s Einstein AI in insurance, insurers can drive innovation, streamline operations, and deliver exceptional customer experiences. As the insurance industry continues to evolve, generative AI will play a pivotal role in shaping its future.

Why AGG?

Access Global Group is a Salesforce Summit (Platinum) level partner with nearly two decades of experience in Salesforce implementation, support, maintenance, and management services. Our team of certified experts knows Salesforce inside and out, meaning that when they come to you, no stone is left unturned and any conflicts are quickly addressed with agility and accuracy. With 5-star ratings on the Salesforce AppExchange and G2, our team offers a unique blend of global deployment expertise coupled with the agility of a boutique firm and a one-of-a-kind project methodology that places our clients at the forefront of every decision. Your successes are our successes, so we’re dedicated to providing solutions that align with your evolving requirements and aspirations.

What are you waiting for? Supercharge your strategy for AI today!

From proposals to quotes, contracts and more, Access Docs allows users to create and send consistent and accurate documentation to clients in a few simple clicks.

A seamless connection between Salesforce and QuickBooks. With automation of key processes, this application works to eliminate manual and duplicative efforts to empower your team.

A seamless connection between Salesforce and QuickBooks. With automation of key processes, this application works to eliminate manual and duplicative efforts to empower your team.

Get the latest Salesforce news

Subscribe to get the latest Salesforce blogs, guides, industry reports, events, and all things Salesforce related!

Let's Get Started on Your Salesforce Project!

Salesforce Innovations Transforming Insurance and Underwriting

At Access Global Group, we are committed to sustainability in every aspect of our operations. As a global leader in technology, specializing in remote work-from-home solutions…

Access Global Group Strategic Partnership With PeerIslands

At Access Global Group, we are committed to sustainability in every aspect of our operations. As a global leader in technology, specializing in remote work-from-home solutions…

Access Global Group Sustainability Annual Report

At Access Global Group, we are committed to sustainability in every aspect of our operations. As a global leader in technology, specializing in remote work-from-home solutions…

Digital Transformation Powered by Dedication & Expertise! Chat With Our Experts Today!