Jenna Trott | June 14, 2023 | 5 Minute Read

Jack Henry and Salesforce are quickly revolutionizing the banking industry. Long before the days of your traditional commercial banks and even before the first currencies were minted, financial institutions took the shape of gilded temples and other places of worship as they were seen as secure locations for wealthy individuals to safeguard their money. A lot has changed since then with the expansion of innovative banking capabilities that empower customers to effortlessly manage accounts, transfer funds, and make deposits without ever leaving the comforts of home. But as with any big change, traditional banks often struggle to keep pace with evolving trends and meet the heightened expectations of their clients. Common challenges such as the lack of a single source of truth, laborious manual processes, and disorganized sales management plague financial industries today. Thankfully, there exists a straightforward and exceptionally powerful solution that is revolutionizing the banking experience for the better. Enter the dynamic duo of Jack Henry and Salesforce—an integration that has the potential to supercharge your bank’s sales strategies and reshape the way people engage with their financial institutions. Let’s take a look at how this integration can propel your bank into a future defined by unparalleled efficiency and customer satisfaction.

What Exactly is Jack Henry – and how does it work?

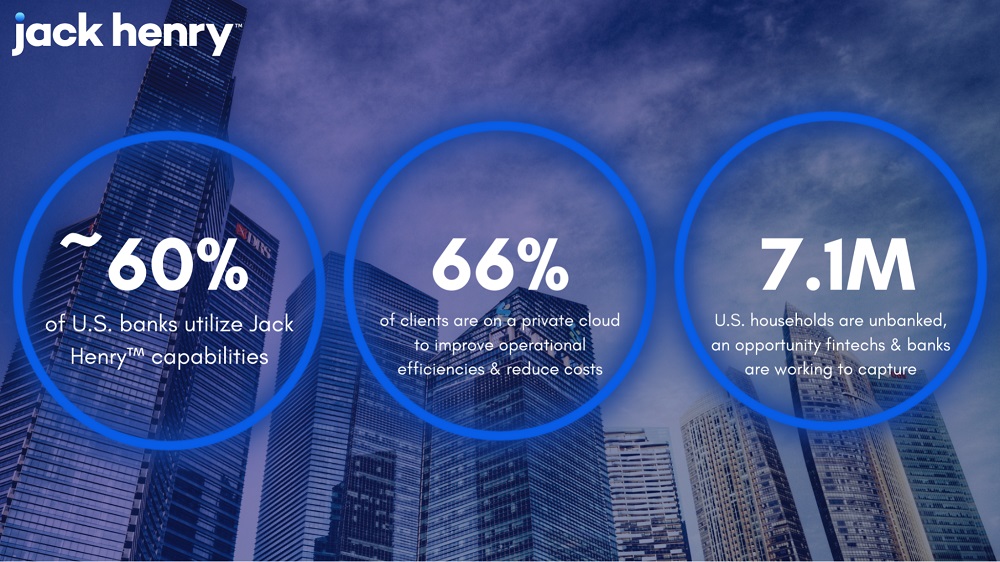

For over 45 years, Jack Henry has prioritized modernization efforts, enabling financial institutions to drive faster innovation, establish strategic differentiators, and achieve enduring success in a competitive landscape. Through cutting-edge technology and a comprehensive range of services, Jack Henry helps remove barriers to financial well-being – and they have. They’ve earned the trust of approximately 8,000 community and regional banks as well as credit unions that have come to rely on their expertise to accomplish short- and long-term objectives. Their extensive range of technology and services are classified into nine key capability types, which include:

→ Digital Banking

→ Payments

→ Operations

→ Information Security & Technology

→ Lending

→ Financial Crimes & Fraud Risk

→ Commercial Banking

→ Customer & Member Relationships

→ Financial Health

So, how do these tools assist financial institutions in fostering growth and success?

Let’s take a look:

→ By automating intricate business processes, enhancing back-office operations, streamlining branch activities, and reimagining the overall account holder experience, Jack Henry helps to significantly improve operational efficiency.

→ By maximizing interchange income, optimizing financial management, and maximizing non-interest and interest income, Jack Henry helps financial institutions overcome revenue challenges.

→ Jack Henry sets the standard for superior risk reduction and fraud prevention. They employ stringent measures to ensure secure information handling, combat financial crimes, and mitigate credit and interest rate risks.

→ Through their innovative solutions and customer-centric approach, Jack Henry empowers individuals to achieve their financial goals while enjoying a seamless and personalized banking experience. This is accomplished by enabling financial health, delivering smarter service, simplifying the borrower experience, and improving depositor acquisition.

→ Jack Henry attracts and grows commercial account holders by competing for loans, supporting cash flow needs, and becoming the preferred destination for businesses to manage their finances.

Benefits of Integrating Jack Henry and Salesforce

On its own, Jack Henry empowers financial institutions with comprehensive solutions that serve as the ultimate financial hub for account holders – but what about when adding a Salesforce integration into the equation? Imagine having a complete 360-degree view of your customers/members – their account information, transactions, and balances – all at your fingertips. With the seamless integration of Jack Henry and Salesforce, this becomes a reality for financial institutions hoping to truly take their business operations to the next level. Benefits include:

→ Say goodbye to scattered data and hello to a consolidated customer view. Real-time updates between your core banking system and Salesforce ensures data accuracy, empowering you with a comprehensive understanding of your customers throughout the entire lifecycle. No more searching through multiple platforms – everything you need is now conveniently accessible on one digital engagement platform.

→ Enhance users’ experiences by enhancing the quality of service delivered. Quickly access loan status, account details, and other critical information without ever leaving the Salesforce platform. Expedite issue resolution, deliver personalized experiences, and leave a lasting impression on your customers.

→ Ready, set, GROW. With all of your data conveniently located in Salesforce, the possibilities for revenue growth are endless. Leverage powerful insights for Next Best Actions and seize cross-selling and upselling opportunities at the perfect moment. By tailoring targeted offers based on customer profiles and preferences, you’ll see your revenue soar to new heights.

These are just a few of the many ways an integration with Salesforce can help to supercharge your team, leading to accelerated growth and ROI.

Supercharged Sales

In the competitive world of banking, a seamless and efficient sales process is essential for driving revenue and business growth. However, many financial institutions face common challenges that hinder their sales efforts. The solution? Jack Henry and Salesforce integration – the ultimate catalyst for revolutionizing your bank’s sales strategy and unlocking its full potential.

→ Close deals faster with Jack Henry and Salesforce integration. Banks often struggle with fragmented membership interactions and a lack of a single source of truth, ultimately disrupting your sales workflow and diminishing revenue-generating activities. These obstacles are overcome with access to a centralized system that consolidates member information; ensuring a streamlined and consistent experience for every interaction, boosting customer satisfaction, and increasing the chances of closing sales.

→ Focus on revenue-generating activities by automating workflows within Salesforce and eliminating manual processes and repetitive tasks that drain productivity and impede seamless experiences. Superior automation improves team productivity thereby enabling agents to create more meaningful member interactions and enhance their own sales performance.

→ Superior sales management thanks to tools that make it easy to monitor and measure sales performance, identify trends, and unlock actionable insights. Leverage readily available visibility into referrals and performance metrics to better optimize your sales strategy, make more informed decisions, and drive sales.

Embracing Jack Henry and Salesforce integration is embracing a tech revolution. Easily optimize your sales operations, and position your bank as an industry frontrunner with streamlined workflows, enhanced productivity, and the data-driven insights your bank will need to climb to new and unprecedented heights of success.

The Difference is Clear: The Case of Mara

Background

Mara had been banking with the same institution for the last year, but fragmented customer interactions and time-consuming processes resulted in mounting frustrations that were becoming difficult to ignore. Finally, Mara decided to switch to a bank that utilized the powerful integration of Jack Henry and Salesforce. This case study showcases the transformative impact of this integration on Mara’s banking experience and highlights how it can help banks retain existing clients plus attract new ones.

Challenges Faced by Mara:

→ Fragmented Interactions: Mara had to navigate through multiple channels and departments, resulting in disjointed interactions and inconsistent experiences. This led to frustration and a lack of trust in the institution’s ability to meet her banking needs.

→ Inefficient Processes: Manual and time-consuming processes wreaked havoc at Mara’s previous bank, causing delays, errors, and wasted time. The lack of automation hindered productivity and negatively impacted her overall satisfaction as a client.

→ Limited Insights and Engagement: Mara felt disconnected from her previous bank, as they lacked the tools and capabilities to provide personalized insights and engage with her effectively. This limited her trust in the institution and left her searching for a better banking experience.

Making the Switch:

Upon switching to a bank that utilized integrations of Jack Henry and Salesforce, Mara immediately noticed a more efficient and customer-centric banking experience. Here’s how the integration transformed her banking journey:

→ Streamlined Interactions and Personalized Engagement: This new bank had a 360-degree view of Mara’s account information, allowing for a personalized and consistent experience across all interactions. This invaluable insight enabled the bank to provide a truly personalized and consistent experience across all interactions. Mara seamlessly transitioned between various channels and touchpoints, enjoying a level of efficiency and engagement that was previously lacking. Ultimately, this instilled a profound sense of trust and loyalty in Mara, solidifying her relationship with the institution.

→ Enhanced Efficiency and Productivity: The automated workflows and streamlined processes powered by Jack Henry and Salesforce significantly improved efficiency at Mara’s new bank. Transactions were processed swiftly, and her inquiries were resolved promptly, saving her valuable time and ensuring a hassle-free banking experience.

→ Actionable Insights and Targeted Sales: The integration enabled this bank to gain comprehensive insights into Mara’s banking patterns, preferences, and needs. Leveraging these insights, they could offer targeted financial solutions tailored to her requirements. Mara received personalized product recommendations, relevant offers, and timely alerts, enhancing her overall satisfaction and deepening her relationship with the bank.

Results and Benefits:

Mara’s positive experience with the integrated Jack Henry and Salesforce solution had a profound impact on her banking journey and the success of the bank.

→ Client Retention: The seamless experience, efficient processes, and personalized engagement helped the bank retain Mara as a satisfied and loyal client. This integration addressed the many pain points that drove her to switch banks in the first place.

→ Sales Growth: Word spread about Mara’s improved banking experience, attracting new clients to the bank! The Jack Henry and Salesforce integration empowered the bank’s sales teams to deliver exceptional service, leverage actionable insights, and provide tailored financial solutions, resulting in increased sales and revenue generation for the bank.

Jack Henry and Salesforce integration proved to be a game-changer for both Mara and her new bank. By eliminating fragmented interactions, streamlining processes, and enabling personalized engagement, the bank not only retained Mara as a delighted client but also attracted new clients through positive word-of-mouth. Jack Henry and Salesforce have the unique ability to drive sales and deliver exceptional customer experiences, positioning the bank as an industry leader committed to meeting (and exceeding!) client expectations.

Why AGG?

When it comes to finding the right partner for technology integration and digital transformation, it’s crucial to find a company with the right experience. That’s precisely what Access Global Group offers with its unique combination of global deployment expertise and a boutique firm’s nimbleness. With over 15 years of diverse industry experience and a Salesforce Platinum-level partner status, Access Global Group ensures that your bank’s needs and expectations are met throughout the integration process. Access Global Group’s expertise in integrating Salesforce and Jack Henry with other financial institutions is invaluable, as is our one-of-a-kind project methodology that places our clients at the forefront of every decision made. Our extensive experience working with Salesforce and the financial services industry further underscores our ability to provide the best possible solutions for your business.

AGG has transformed a number of banking institutions with our seamless integration of Jack Henry and Salesforce, unlocking the benefits of a truly comprehensive Customer 360 view. We eagerly invite you to share the challenges your company is currently encountering and how our highly curated solutions may help.

Get the latest Salesforce news

Subscribe to get the latest Salesforce blogs, guides, industry reports, events, and all things Salesforce related!

From proposals to quotes, contracts and more, Access Docs allows users to create and send consistent and accurate documentation to clients in a few simple clicks.

A seamless connection between Salesforce and QuickBooks. With automation of key processes, this application works to eliminate manual and duplicative efforts to empower your team.

A seamless connection between Salesforce and QuickBooks. With automation of key processes, this application works to eliminate manual and duplicative efforts to empower your team.

Let's Get Started on Your Salesforce Project!

Salesforce

PLATINUM

PARTNER

Salesforce

APPEXCHANGE

G2

USER REVIEWS