The Future of Automation: Digital Process Automation

Jenna Trott

Jenna Trott

5 min read | August 4, 2022

No matter which industry you work within, customer satisfaction is likely a top priority. However, within the last few years, the state of consumer interactions have seen a dramatic shift, straying further from face-to-face communication to a digital first model. Let’s take a quick look at just how significantly client interaction trends have changed since the onset of the pandemic:

- 60-70% of consumers are shopping in an omnichannel way; with social media being the new “window shopping”

- E-commerce sales continue to grow, rising by 35% a year

- The e-commerce penetration rate remains to be 30% higher than it was pre-pandemic

- Within a 3-month period, over 65% of consumers exhibited new shopping behaviors (online, digital, etc.)

- When faced with an “Out of Stock” item, over 39% of consumers will switch brands or products rather than wait for a restock

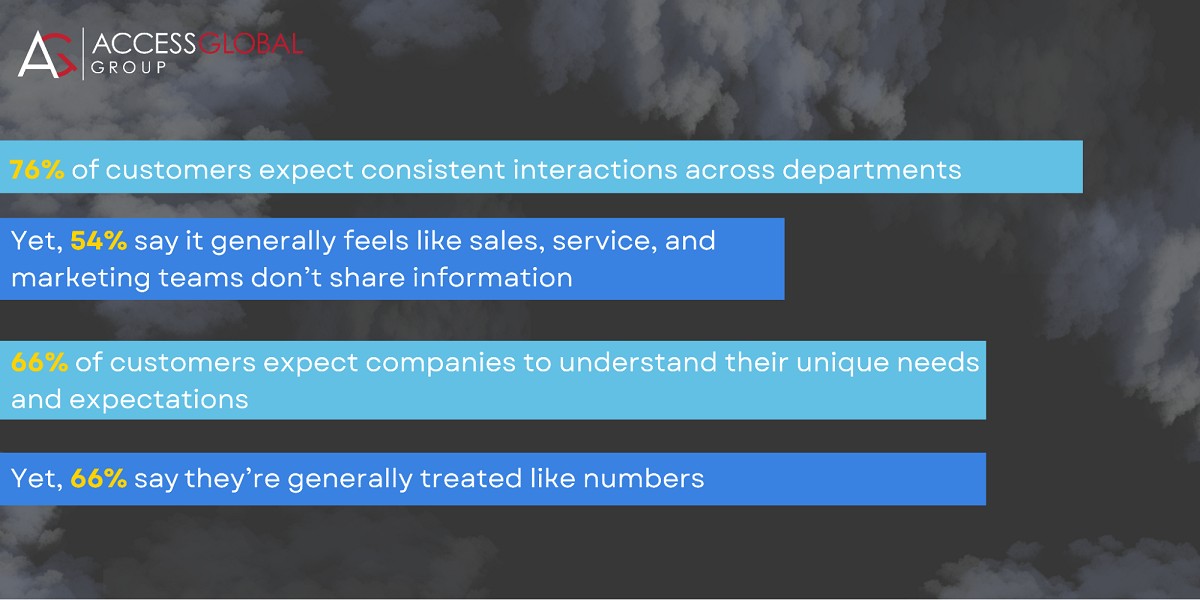

So, what is it that customers want? They’re not only looking for convenience, but they’re looking for personalized interactions, 24/7 service, real-time feedback and updates, remote assistance, contextual engagement, proactive alerts and much, much more.

Having a 360-degree view of clients and customers has become more than just important, it’s become essential. However, companies need to be able to acquire said customer information even faster, complete with real-time insights so your team can add more value to every interaction and promote operational efficiency throughout the business. How?

This is where Salesforce’s Digital Process Automation (DPA) comes in.

What is DPA?

Digital Process Automation is an intelligent toolset built on Omnistudio to create customer-focused digital experiences quickly while enabling automated, connected and end to end work orchestration with ease. An important thing to note is that Digital Process Automation has been renamed to “Salesforce Flow” in the latest Salesforce Summer ‘22 release. DPA (aka Flow) had previously been a subscription add-on prior to the recent release, however, it is now included with Unlimited Editions of Financial Services Cloud, Health Cloud, and Manufacturing Cloud. As of June 2022, Unlimited Editions of FSC, MC, and HC will receive 1M Omnistudio Calls per org, per month and 50k Business Rules Engine Calls per org, per month.

What tools are included?

The tools included with Digital Process Automation are the following:

What tools are included?

The tools included with Digital Process Automation are the following:

- OmniStudio: a suite of task-based components for delivering customer experiences across multiple channels and devices

- Data Processing Engine: for workflow orchestration and rollup calculations on large data sets

- Decision Tables: to support rule-based workflow automation

- Intelligent Document Automation: features to help accelerate end-to-end document generation, inputting, tracking, and approval processes

How does it work?

Digital Process Automation works by offering companies an easy way to automate and accelerate key business workflows so reps can focus on closing bigger deals faster. Visual workflow mapping capabilities allows users to trigger actions and make decisions based on a collection of rules that consider both inputs and outputs. Simply select an object, set your criteria and specify the action that’s triggered when the criteria is met and you’re ready to go! Imagine having the ability to automate all your sales processes and instantly send new lead follow-ups directly to your reps’ mobile devices. DPA allows this and much more. Connect sales reps with executives, support cross team collaboration, trigger tasks and reminders, deliver superior guided experiences and infuse customer data throughout every interaction with a simple click.

How can it help the financial services industry?

Whether you work in fins or are a customer, it’s likely that this thought has crossed your mind more than once: how many times do I have to enter the same information to open an account or speak to customer support?!

Many financial institutions suffer from repetitive-information complexes due to disconnected systems, ultimately causing laborious work processes that can make it feel like you’re operating in the 1980s instead of the 21st century. This not only affects overall company efficiency, but it also creates significant gaps in the client experience as well. Here are common instances where Digital Process Automation can help to elevate the customer experience and boost productivity within your org:

Bank Account Onboarding

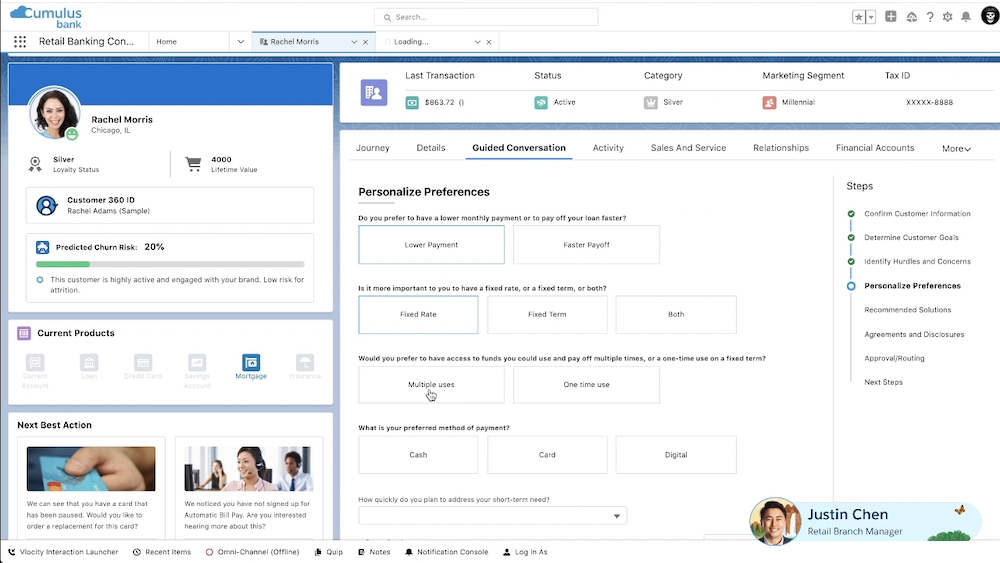

Opening a bank account can be incredibly time consuming and burdensome due to heightened regulatory demands as well as compliance and control pressures. DPA streamlines this process, within regulatory bounds, by enabling a guided conversation to help bankers get to know customers more efficiently. The result is a customer who feels more understood and bankers who have more insight into better recommendations and next best actions for the people they serve.

Increasing Speed to Market and Meeting Reuse Priorities

Thanks to Salesforce DPA’s low to no code solutions, companies are able to reduce the need for specialized talent to instead utilize OmniStudio tools across channels out-of-the-box. This accelerates technology modernization, speed to market, and reuse priorities.

Disputing Transactions

You know the feeling, you’re looking at your transaction history and see an unfamiliar charge for a large sum of money and instantly a knot forms in the pit of your stomach. When calling up their financial institution, they’re looking for someone to quell their worries, not bump them from support agent to support agent. Digital Process Automation eliminates that back and forth so financial firms offer the right solutions in real-time. In just one call, one person can generate documents to confirm what happened and calculate refunds all on one activity stream.

Check Credit Scores Without Coding

Typically, if you needed to check a credit score as part of a transaction, IT or a Salesforce Admin would need to encode rules related to the credit check for each process needing one. With DPA, users can create a simple rule to allow easy credit checks with clicks instead of code.

Think of your financial institution as an orchestra, with all the separate parts of your business acting as violins, cellos, trumpets and pianos, except instead of playing in harmony, they’re blaring noisily incongruous of one another. Think of Digital Process Automation as the conductor, bringing back harmony to the ensemble, allowing you to work more efficiently – together.

Want to learn more about Digital Process Automation? Reach out to our Salesforce Summit Level Consulting Partners!

Get the latest Salesforce news

Subscribe to get the latest Salesforce blogs, guides, industry reports, events, and all things Salesforce related!

FREE Salesforce Assessment!

To demonstrate confidence in our ability as Salesforce Partners, we’re offering you the a FREE Salesforce Organizational Assessment.

Schedule Today!

Salesforce

PLATINUM

PARTNER

Salesforce

APPEXCHANGE

G2

USER REVIEWS