Tech Investment Trends in Insurance: Priorities for 2024 and Beyond

Jenna Trott | SEPTEMBER 13, 2023 | 5 Minute Read

As the economic landscape continues to undergo seismic shifts, one thing remains constant: the need to adapt and thrive in the face of changing economic conditions. Insurers have shown a remarkable resilience by continually investing in technology to stay ahead of the curve. But as we look forward to 2024 and beyond, the focus is shifting from casting a wide net of technological investments towards a more focused, strategic approach. Arizent, a leading publisher in financial and professional services, conducted research among 83 insurance sector professionals in December 2022 to understand the tech landscape within the industry. The survey revealed that a majority of insurance organizations anticipate an increase in tech spending in the coming year. In this article, we’ll be exploring what insurers are investing in, why, and why these choices may not be the best option for long-term, sustainable growth.

The Who, What, and Why

So, insurers are investing in tech – but what tech exactly? As we move through 2023 and beyond, it becomes evident that insurers are giving top priority to tech investments that bolster security, excel in data collection and analysis, streamline customer onboarding and origination, and facilitate process automation.

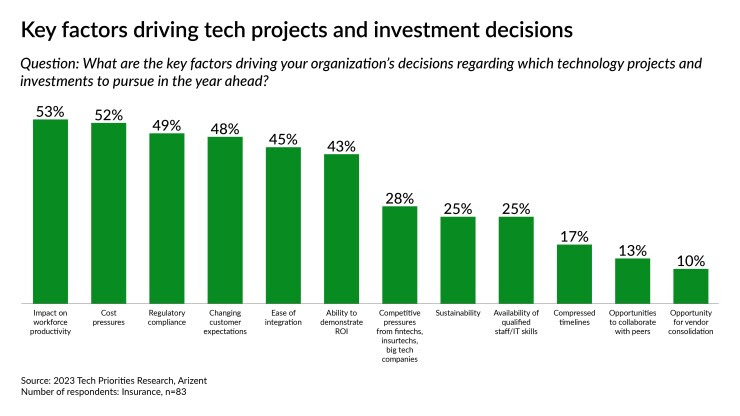

Why? Research reveals that these choices are driven by their anticipated impact on workforce productivity, cost considerations, regulatory compliance, and the consistent evolution of customer expectations. While these investments may prove to be lucrative, there may be a simpler solution that’s being overlooked. While on the list, core systems modernization is not seen as a priority, with only 42% of insurers looking to make enhancements in the coming year.

→ System Inefficiencies: Inefficiencies in underwriting, claims processing, and customer service can result in longer processing times, increased errors, and higher operational costs.

→ Business Stagnation: Outdated systems make it difficult to adapt quickly to changing market conditions, regulatory requirements, and customer demands – therefore making it difficult to remain competitive, leaving your company at risk of falling behind.

→ Non-Compliant: Insurance is a highly regulated industry, and compliance requirements are constantly evolving. Outdated systems may struggle to keep up with these changes, leading to compliance risks and potential penalties.

→ Customer Dissatisfaction: In today’s digital age, customers expect a seamless and convenient experience when interacting with insurers. Outdated systems can impede the delivery of modern, user-friendly services, resulting in customer dissatisfaction and attrition.

→ Costly Maintenance: Maintaining and patching legacy systems can be expensive. As these systems age, the cost of maintenance and support tends to increase, diverting resources from strategic initiatives.

→ Longer Time-to-Market: Developing and launching new products or entering new markets can be a lengthy process with legacy systems. Modern systems enable insurers to reduce time-to-market, which is crucial in responding to market trends and customer demands.

Oftentimes, when insurers seek to address the limitations of their aging core systems, they tend to bypass the core itself and, instead, opt for the belief that layering multiple technological solutions on top will suffice to resolve the issues at hand. Unfortunately, this approach often results in the unintended consequence of data silos, obscuring vital insights and opportunities that could otherwise be capitalized upon.

Rather than pursuing an expansion of investments, a more prudent approach involves a strategic reduction. Through the integration of these core systems with Salesforce, insurers can effectively attain the very thing that initially motivated their investments: heightened workforce productivity, cost-cutting measures, compliance adherence, and meeting evolving client expectations – all while sustaining their competitive edge and optimizing return on investment.

How? Let’s take a look

How Salesforce Can Help

There’s a common misconception that exists within the world of technological advancements that suggests success can only be achieved by ripping the company’s current core system or complicating it with a myriad of other products and services. Enter Salesforce, the key to unlocking the true value of your core system and achieving a comprehensive customer 360-degree view. It’s not about discarding what you have; it’s about strategically wrapping and extending your core system with Salesforce’s powerful capabilities to augment and maximize your current system’s potential. This approach ensures that you harness the full spectrum of benefits, from seamless customer relationship management to data-driven insights, advanced automation, and beyond. Users who leverage Salesforce with their core system can expect to see the following benefits:

Superior Workflow Automation that enables insurers to automate routine tasks, reduce manual efforts, and eradicate the likelihood of costly errors. This results in increased operational efficiency and cost savings.

Maintain Compliance with industry regulations and data security standards, thanks to an array of tools and features specifically designed to help insurers mitigate compliance risks and potential penalties.

Maximize Productivity with Salesforce’s user-friendly interface and automation features. Empower employees to work more efficiently, resulting in increased productivity and giving insurers the confidence to handle a larger volume of business without additional resource strain.

Achieve True Customer 360 by consolidating customer data from various sources into a unified view. This holistic perspective empowers insurance professionals to understand customer needs better, tailor offerings, and provide more personalized services.

Supercharge Sales with top-tier sales management tools. Bidirectional synchronization allows for the seamless generation of account and contact information, along with opportunities, ensuring that insurers can reach out to the right customer at exactly the right time.

Exceptional Analytics and Reporting Tools provide actionable insights. Insurers can make data-driven decisions, identify trends, and forecast accurately, ultimately leading to improved underwriting, risk assessment, and profitability.

This only begins to scratch the surface of what’s possible when integrating Salesforce with an insurer’s core technology system. Users can optimize customer engagement, automate processes, provide data-driven insights, and enhance overall efficiency. This not only improves the insurer’s bottom line but also strengthens their ability to meet customer expectations in an ever-evolving insurance landscape.

Core Systems that Salesforce works well with

When it comes down to it, Salesforce is an incredibly versatile platform that can integrate effectively with a wide range of insurance core systems to enhance operations and customer engagement. Some insurance core systems that work well with Salesforce include:

→ EZLynx

However, the effectiveness of system integration hinges on the quality of the integration process itself, underscoring the vital importance of selecting the right partner for technology integration and digital transformation.

Why AGG

Insurance companies are dedicated to safeguarding their clients’ interests and providing protection against unexpected events. But who can insurers trust and rely on to help achieve their goals? This is where Access Global Group (AGG) shines, offering a unique combination of global deployment expertise and the flexibility of a boutique firm. With a strong track record spanning over 15 years across diverse industries and holding the prestigious Summit (Platinum)-level partner status, AGG goes above and beyond to meet and exceed the needs and expectations of your financial institution throughout the integration process.

AGG excels in seamlessly integrating a variety of core insurance systems with Salesforce. We follow a client-centric project methodology, ensuring that your requirements and aspirations guide our solutions. Our extensive experience with Salesforce and the financial services industry underscores our ability to provide tailored solutions that perfectly align with your business objectives.

Get the latest Salesforce news

Subscribe to get the latest Salesforce blogs, guides, industry reports, events, and all things Salesforce related!

From proposals to quotes, contracts and more, Access Docs allows users to create and send consistent and accurate documentation to clients in a few simple clicks.

A seamless connection between Salesforce and QuickBooks. With automation of key processes, this application works to eliminate manual and duplicative efforts to empower your team.

A seamless connection between Salesforce and QuickBooks. With automation of key processes, this application works to eliminate manual and duplicative efforts to empower your team.

Let's Get Started on Your Salesforce Project!

Salesforce

PLATINUM

PARTNER

Salesforce

APPEXCHANGE

G2

USER REVIEWS