Beyond Boundaries: How Salesforce Transforms Insurance Core Systems

Jenna Trott | APRIL 13, 2024 | 5 Minute Read

The last few years have presented insurance companies with dynamic and rapid market shifts that make change the only constant in this ever-evolving landscape. From navigating evolving regulations to meeting increasingly sophisticated customer demands, insurers face a multitude of challenges. Despite the pressing need to adapt to today’s inflationary climate, the insurance sector has been notably slow in its embrace of digital transformation. This begs the question, why?

Factors such as strict regulations, extensive existing portfolios, and financial barriers for newcomers have impeded progress. As co-founder of QED investors, Caribou Honig aptly puts it, “It’s hard for big carriers to innovate as they have so much to contend with already—industry headwinds, legacy issues. But they need to be in the game, right now.” Amidst this backdrop, it’s crucial to explore innovative solutions. While Salesforce has long been synonymous with superior Customer Relationship Management (CRM), its potential to address the insurance industry’s most pressing issues deserves attention. This article will explore how insurers can leverage the versatility of the Salesforce platform to achieve digital transformation without upending their core systems. Let’s take a look at how.

Why Insurance Companies Struggle with Digital Transformation

The current state of innovation within the insurance sector has been likened to the “Red Queen Effect” by Forbes. Named after a character in Lewis Carroll’s “Through the Looking-Glass,” it refers to a phenomenon in business and economics that describes situations where entities must continuously innovate and improve just to stay competitive and maintain their current position. However, these efforts merely keep insurance companies astride their competition rather than truly propelling them forward.

While insurers may find it wise to kickstart transformation by upgrading core systems, this approach often proves counterproductive. It’s similar to planning a simple kitchen upgrade but beginning with a full-scale renovation of the entire house. Consequently, the original project takes far too long, and by the time the ordeal is finished, both the full renovation and the kitchen are already outdated again.

Core system upgrades can be time-consuming and expensive projects that may not encompass the latest technologies essential for streamlining workflows and enhancing customer experiences. How expensive? It was revealed in a 2020 McKinsey study that the costs associated with these upgrades could easily soar beyond $100 million for mid-cap banks, making it essential for insurers to explore innovation paths that embrace emerging technologies and prioritize customer-centric solutions without breaking the bank. Further, innovation is imperative when considering the pattern of sameness competitors can fall into. By upgrading only their core system, insurers miss out on the opportunity to leapfrog ahead with innovative technologies.

Let’s take a look at what insurers can do to accelerate digital transformation without overextending their initiatives (or budget)!

Understanding Salesforce’s Role in Digital Transformation

Salesforce, known for offering tools for meaningful change, plays a pivotal role in the digital transformation journey of the insurance industry. A range of highly intuitive features and capabilities help address the evolving and unique needs of insurers:

Versatility and Integration

Salesforce serves as a versatile platform, catering to various aspects of insurance operations such as policy administration and claims handling. Its integration capabilities facilitate seamless connectivity with legacy systems, third-party data sources, and emerging technologies like AI, ensuring insurers stay ahead in an ever-changing landscape.

Automation and Efficiency

With Salesforce’s automation capabilities, insurers can streamline underwriting processes and claims intake, reducing manual tasks and enhancing operational efficiency. The platform’s scalability enables insurers to efficiently manage product configurations and claims assignments, allowing them to adapt swiftly to shifting market demands.

Customer-Centric Innovation

Salesforce empowers insurers to deliver personalized interactions and cultivate lasting relationships with policyholders by providing tools for a comprehensive 360-degree customer view. Additionally, the continued advancements with Einstein technologies highlight its ability to effectively unlock siloed data, offering a unified platform that reveals valuable customer insights.

With robust and versatile solutions tailored for insurance companies, Salesforce serves as a notable catalyst for change, tackling key industry challenges while unlocking new opportunities for innovation and growth.

Key Benefits of Integrating Salesforce with Insurance Core Systems

In a rapidly evolving technological landscape, insurers must adopt agile approaches to innovation. Instead of embarking on lengthy core system overhauls that can span years, industry leaders should prioritize shorter-term tech projects with quicker implementation times, such as integrating Salesforce. The benefits of integrating Salesforce with insurers’ core systems are significant; let’s take a look at just a few of these advantages:

Enhancing Customer and Policy Management

- Organized data within Salesforce enables insurers to understand prospects’ needs better and track comprehensive policyholder information, fostering personalized service delivery and improved customer relationships.

- Salesforce’s automation capabilities streamline the underwriting process, enhance product customization, and automate claims management, enabling insurers to reduce manual tasks, respond swiftly to market demands, and optimize efficiency in claims handling.

- Salesforce empowers enhanced agent and customer engagement by providing real-time policy information and analytics to agents and brokers for improved collaboration, facilitating seamless internal and external communication through its collaboration tools, and leveraging its capabilities to offer personalized interactions and AI-driven recommendations based on a comprehensive 360-degree customer view.

- Salesforce equips insurers with comprehensive customer insights by offering a 360-degree view of the customer, facilitating personalized interactions and AI-driven recommendations.

- Leveraging intelligent data utilization, insurers can enhance understanding and service delivery by personalizing customer journeys based on high-value data collected at every touchpoint.

- By leveraging AI for risk profiling and premium pricing adjustments, insurers can provide tailored insurance experiences, while automated workflows streamline decision-making and operational processes, such as claims documentation, through real-time guidance and automation.

- Salesforce Service Cloud offers a unified service experience by ensuring consistency across all service channels, including traditional communication, chatbots, and self-service portals, thereby enabling customers to easily reach out on their preferred platform.

- Routine tasks such as quote generation, policy issuance, and renewal reminders are automated, freeing up valuable time for strategic activities.

- Integration creates a centralized view of the entire insurance portfolio within Salesforce and offers unparalleled insight, aiding in decision-making and policy management.

- By integrating core systems with Salesforce, manual data entry, and duplication are eliminated. Further, key customer information, policy information, and quotes are automatically synced, ensuring data consistency and accuracy.

- Salesforce’s robust analytics capabilities allow insurers to gain insights from their data, helping them make informed decisions, identify trends, and uncover new business opportunities.

- Integration facilitates collaboration among internal teams, agents, and brokers by providing tools for real-time communication, document sharing, and task management. This not only leads to improved teamwork and increased productivity but also better customer service.

Put simply, integrating Salesforce with insurers’ core systems isn’t just about staying competitive; it’s the transformative solution needed to surpass competitors and redefine industry standards entirely.

How Salesforce Consultants Can Help

It’s important to remember that the path toward digital transformation is not linear. It’s not about employing the latest and greatest solutions. And it’s not about ripping and replacing existing systems. Particularly for insurance companies, significant transformation can occur by the strategic enhancement of core systems. However, stringent regulatory and compliance requirements often hinder the pace of this evolution. Here’s where Salesforce consultants step in: they can ensure that your core systems, when integrated with Salesforce capabilities, remain aligned with regulatory and compliance standards. By leveraging their expertise, insurers can navigate these complexities while accelerating their digital transformation efforts, ultimately staying ahead in a competitive landscape:

Thorough Assessments and Planning of your current insurance core systems by a Salesforce consultant enable them to develop a comprehensive integration plan tailored to your organization’s unique needs and goals.

Superior Customization and Configuration of Salesforce allows for seamless integration with your insurance core systems. Consultants may configure data mappings, build custom workflows, and develop integrations using Salesforce APIs or middleware solutions.

Migrate Data from your existing systems to Salesforce, ensuring accuracy, integrity, and compliance with regulatory requirements. Salesforce consultants may also help cleanse and standardize data to optimize its usability within Salesforce.

Integration Solutions are developed and implemented to facilitate seamless communication and data exchange between Salesforce and your insurance core systems. This includes real-time synchronization of data, batch processing, and event-driven integrations.

Rigorous Testing is conducted by consultants to ensure that the integration operates as intended and meets your business requirements. They also identify and address any issues or discrepancies, ensuring a smooth transition to the integrated system.

Training and Support are provided to your team to ensure they understand how to effectively use the integrated system. Salesforce consultants help drive user adoption and ensure that your team can leverage Salesforce confidently and to its full potential.

Ongoing Support and Optimization Services are offered by Salesforce consultants to ensure the continued success of the integrated system. They monitor performance, address any issues or enhancements, and provide guidance on best practices for maximizing the value of Salesforce in your insurance operations.

As insurance companies navigate the complexities of digital transformation, it’s important to remember that strategic enhancements to core systems are possible, rather than simply adopting the latest solutions or replacing existing ones. With this understanding in mind, exploring integration options with Salesforce becomes essential for driving innovation and efficiency in insurance operations.

Options for Integration

Insurance companies play a vital role in safeguarding their clients’ most valuable assets. However, in their journey to build trust, it’s essential to have the right allies in their corner who share their goals. This is where Access Global Group (AGG) comes in, offering a unique blend of global deployment expertise and the agility of a boutique firm. With over 15 years of proven experience across diverse industries and holding the prestigious Summit (Platinum) partner status, AGG goes above and beyond to ensure that your financial institution’s needs are not just met but exceeded throughout the integration process.

When it comes to integrating insurance core systems with Salesforce, AGG’s unmatched proficiency is invaluable. Our unique project methodology prioritizes our clients’ requirements and aspirations, driving our solutions forward. With extensive experience in both Salesforce and the financial services industry, we are well-equipped to deliver tailored solutions that perfectly align with your business objectives.

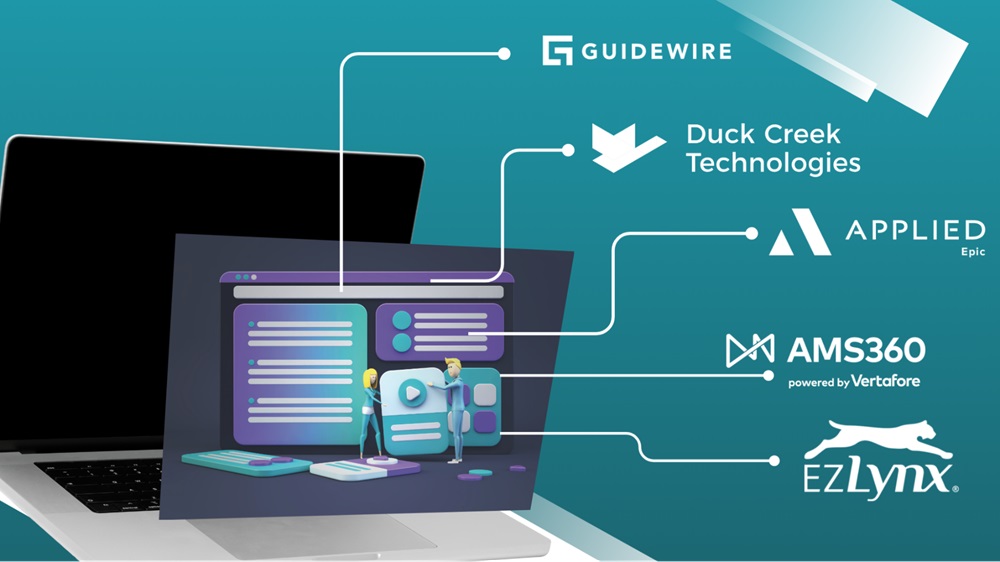

It should also be noted that there are notable benefits to integrating Salesforce with AMS systems, as it can revolutionize insurers’ operations, streamline data management, deepen customer insights, and revolutionize workflow automation. The result is a symbiotic relationship that enables insurers to boost efficiency, personalize marketing strategies, and enhance overall customer experience.

AGG also excels in AMS platform integrations; here are s few examples:

Whatever you’re looking to achieve, reach out to us and we’d be happy to discuss a solution that best fits your needs at this time!

From proposals to quotes, contracts and more, Access Docs allows users to create and send consistent and accurate documentation to clients in a few simple clicks.

A seamless connection between Salesforce and QuickBooks. With automation of key processes, this application works to eliminate manual and duplicative efforts to empower your team.

A seamless connection between Salesforce and QuickBooks. With automation of key processes, this application works to eliminate manual and duplicative efforts to empower your team.

Get the latest Salesforce news

Subscribe to get the latest Salesforce blogs, guides, industry reports, events, and all things Salesforce related!

Let's Get Started on Your Salesforce Project!

Salesforce Innovations Transforming Insurance and Underwriting

At Access Global Group, we are committed to sustainability in every aspect of our operations. As a global leader in technology, specializing in remote work-from-home solutions…

Access Global Group Strategic Partnership With PeerIslands

At Access Global Group, we are committed to sustainability in every aspect of our operations. As a global leader in technology, specializing in remote work-from-home solutions…

Access Global Group Sustainability Annual Report

At Access Global Group, we are committed to sustainability in every aspect of our operations. As a global leader in technology, specializing in remote work-from-home solutions…

Digital Transformation Powered by Dedication & Expertise! Chat With Our Experts Today!